FAANG Stocks: How to Invest in FAANG

Many people who are somehow connected with the market, probably have heard such an acronym as FAANG. For those who do not know what it is, how the acronym is deciphered, and what shares of companies are included in the FAANG, this short article is written. In a nutshell, FAANG is the stock of the five most popular and best-performing American technology companies, which we will discuss today.

What Are FAANG Companies?

The acronym is made up of the first letters of the tickers (abbreviations) of companies on NASDAQ (an American exchange specializing in stocks of high-tech companies, one of the major U.S. stock exchanges): FB, AMZN, AAPL, NFLX, GOOGL. Originally it looked like FANG - it did not include Apple stock.

The acronym appeared in 2013 at the suggestion of Mad Money host Jim Cramer. He stated that these companies should be chosen for successful investing because they represent the future, dominate their market, and their stocks have strong growth momentum.

The acronym has, for the most part, only a media meaning, as there is no FAANG index. But there is a FANG+ index, which in addition to these five giants includes Twitter, Nvidia, Tesla, and China's Baidu, Alibaba, and Tencent.

The Popularity of FAANG Stocks

All of these corporations are American, but they operate all over the world. The total market capitalization of these financial giants exceeds $4 trillion. Thus, they represent not only one of the most important sectors of the U.S. economy, but also a significant part of the country's stock market itself.

The ecosystem that these companies form is of enormous interest not only to specialists from related fields but also to ordinary users. Every day we consume a huge amount of content, communicate with messengers, search for some information on the Internet, or buy things there. Whether you like it or not, you constantly come across one company or another from this ecosystem. Of course, this is also due to the quality of their services. So, today we are going to take a closer look at the principles of these world-renowned companies.

For the last ten years, when we talk about technology, we most often mean the field of IT. With the advent of the Internet, almost the entire business space has fallen under the influence of a new wave of technology companies. Not only are they hugely important to progress, but they can also influence supply and demand indicators, i.e., how people consume content and buy various products.

Such companies are often glimpsed in the news and discussed everywhere. And for good reason. Here are a few factors why these companies manage to get so much attention:

In a sense, some of the FAANG companies (like Meta, Alphabet, and Netflix) literally attain yield by getting the attention of huge numbers of people. It could be advertising, or it could be a streaming service selling subscriptions.

Rapid growth. Of course, the fact that all FAANG companies have been able to become a multi-billion dollar business in a relatively short period is nothing short of amazing. In 2017, for example, Facebook's revenue used to exceed $40 billion. While Google's revenue surpassed the $110 billion threshold, Apple was by far the technology company with the highest revenue: almost $230 billion.

They are "opinion leaders," which means they can already influence global trends. From the field of IT development itself to business models, to fashion trends. Netflix series has been a huge influence on the fashion industry and many other rather unexpected industries for several years now.

As we've mentioned, FAANG companies have had a huge impact on the general perception of entrepreneurship in general.

It should be noted that each of these companies uses a different business model, and their level of income varies markedly. In some cases, the lower lucrativeness may be due to the industry in which the company operates. For example, even though Amazon has the second-highest revenue (right after Apple), this company has the last-highest net return (after Netflix).

The History Of FAANG Stocks And How They Generate Income

Jim Cramer coined the term back in 2013. In 2017, Apple joined the ranks of FANG and transformed the acronym into FAANG.

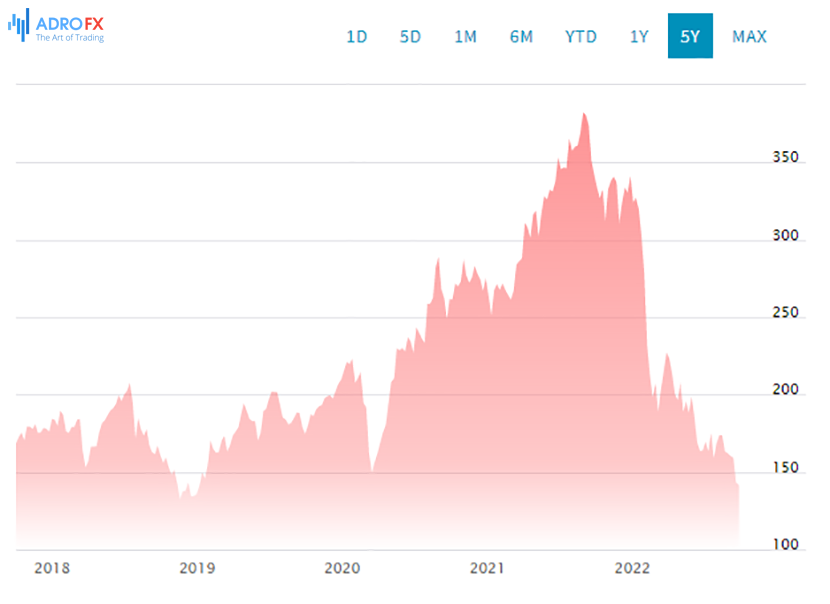

Chances are you know and have even used the services of almost every one of them. They are familiar brands, products, and services that are ever-present in our daily lives. They have long been part of the success story of American corporations. Each one's stock has continued to skyrocket year-over-year since 2015.

Let's take a closer look at each company.

Meta Platforms (FB)

It is no longer just one social network. Today, Meta also owns the popular social network Instagram and the messenger WhatsApp. Its business model is based on attention, which with the help of special algorithms has allowed it to gain more than 1.96 billion users (as of April 2022).

As the company itself states, its entire business model is based on five pillars:

Facebook itself, allows people to communicate using various devices. Of course, this alone would not be enough today, so there are several other different ways to interact with people, the most important of which is the newsfeed, which also displays personalized advertisements composed according to a special algorithm.

Instagram is a social network based on the photo and video sharing.

Messenger is a messaging application that allows people to easily communicate across platforms and devices.

WhatsApp - is another fast, easy and reliable messaging app that is popular worldwide for its security and privacy.

Oculus - specializes in creating hardware and software for virtual reality.

It is accepted that of all these items, the Facebook newsfeed is the most important component, as it is the main platform for attracting new users and the place where the company can monetize its users.

Apple (AAPL)

Apple's business model can be roughly divided into products and services. It is still a manufacturing company, with half of its revenue coming from iPhones. Other fast-growing segments are services (digital content, cloud storage, licenses) and other types of devices and accessories (AirPods and Apple Watch).

However, you can't assume that all of Apple's success is just that. It's the combination of new software and devices that have made the company famous. Of course, the iPhone is already part of modern history, but its popularity is also due to its good performance thanks to its software.

Amazon (AMZN)

The world's largest marketplace for a variety of goods, operating under a diversified business model. Online store sales, as the dominant revenue stream, saw $66.08 billion in net sales—consistent with results compared to Q4 in 2020. Amazon’s physical stores saw a 17% increase compared to a year prior, reaching nearly $4.69 billion in net sales.

This means that Amazon will continue to expand globally, more and more touching the services segment (for example, what Amazon Prime is already doing).

Netflix (NFLX)

Netflix's business model is based on a streaming subscription service. There are three plans: basic, standard, and premium. All of them provide access to a library of series, movies, and shows. And the difference between the subscription options is in their terms and features. The company generates a lot of revenue, but it has negative cash flow due to license purchases and production of its original content, which is what makes it so popular.

Alphabet (GOOGL)

Of course, Alphabet's main revenue stream is advertising (including YouTube ads). Other sources may include Google Cloud, Google hardware, Google Play, and YouTube Premium content.

The company`s advertising business model is based on displaying relevant ads. These ads appear at the right time and provide people with useful commercial information. On average, this segment generates more than 60% of Google's revenue.

Features of FAANG Companies

For investors, the technology sector is becoming more globally important every year as the wave of high-tech companies continues to pick up steam. Shares of these companies can now be classified as one of the best investment options if you want to grow your capital. Even though FAANG companies are already quite "mature," they still seem to have a lot of potential for further growth. According to the technology-oriented Nasdaq Composite mainstream index, they can be classified as dominant companies.

In addition to Meta Platforms and Netflix, which mainly benefit from advertising and membership fees, Amazon, Apple, and Alphabet have more diversified revenue.

In 2021, Google made, more than percent of its revenue from advertising, but it is now far from its main business.

Although online shopping is still Amazon's main source of revenue, other business segments are very interesting and could become massive in the next decade.

Generally speaking, the phenomenon of Amazon is that it was created as an experimental business unit, which later evolved into a competitive and large independent business. Again, as we said above, the company also began to generate a significant portion of its revenue through the creation of a subscription-based program, Amazon Prime.

Another interesting aspect of Amazon is its ability to generate revenue through advertising and third-party seller services. That is, their business model allows them to generate revenue from several different streams at once.

Apple's revenue still relies mostly on literal tech sales (mostly iPhones). Apple's strength definitely lies in the brand and the unique experience the company has been able to gain from selling its devices.

Investing In FAANG Stocks

There are several ways to invest in FAANG:

Individual Stocks

Meta Platforms, Apple, Amazon, Netflix, and Alphabet is listed on the Nasdaq. You can buy individual shares of each of the five companies and assemble your little FAANG portfolio. But, of course, you should keep in mind that shares of these financial giants are quite expensive: from a hundred dollars to several thousand dollars per share.

Technology Funds

No mutual fund or exchange-traded fund (ETF) is designed exclusively for the FAANG group of companies. But any technology-focused fund is likely to include their stock. It's best to look for those funds that invest at least 80% of their assets in stocks.

Index Funds

This is a type of mutual fund or exchange-traded fund (ETF) that follows an index investment strategy. Given their financial position, the FAANG Five will carry a lot of weight in many market index funds, such as the First Trust Dow Jones Internet Fund (FDN) or the fund tracking the Nasdaq Composite Index (IXIC).

Why FAANG Stocks Are Considered Safe Haven Assets And New Gold

Whenever the market is volatile or a stock market correction is expected, people invest in the safest instruments. That might be U.S. Federal Reserve receipts or gold. But the rates on U.S. debt receipts are traditionally low, and gold is gradually ceasing to be an insurance instrument for investors.

That is why many investors have started to invest in FAANG shares: they do not lose so much in value compared to stock indices, they have a clear income and expense structure, they are less exposed to political factors, and show good returns over the years.

That's why many people choose FAANG in times of instability over gold and U.S. Treasury securities.

Conclusion

Thus, the companies which make up FAANG are not only considered technology companies but also so-called blue chips (shares of the largest, most liquid, and reliable companies with stable yields as well as these companies themselves).

FAANG companies have managed to attract incredible attention. Not a day goes by that one of them is not in the news. And the main question today is how long will they be able to maintain this rate of growth and will these companies be so popular in ten, twenty years?

Investing in FAANG stock may well make sense, but it's important to evaluate the value of each one before you decide to buy. Compare the value of the stock to that of competitors to see if it's worth it. Don't forget to assess your stock portfolio, too, to make sure it's fully aligned with your investment goals and values.