Defensive Stocks: A Safe Haven for Stable Returns During Market Volatility

In the unpredictable world of investing, where market trends can change overnight, defensive stocks stand out as a safe haven. These stocks are particularly important during economic downturns or periods of market volatility. While most stocks may suffer from the turbulence, defensive stocks tend to remain stable, offering a cushion for investors when the market takes a hit.

Defensive stocks, also known as defensive shares, are typically from industries that provide essential goods and services, which people continue to use regardless of economic conditions. This reliability makes them an attractive option for conservative investors or those looking to protect their portfolios from market declines.

Definition of Defensive Stock: Key Characteristics

Defensive stocks stand out for their resilience, offering investors a sense of security when the broader market faces challenges. These stocks are not just a fallback option during tough economic times but a strategic choice for long-term stability. To understand why defensive stocks are so reliable, it’s essential to explore the core characteristics that define them. By focusing on steady performance and lower risk, defensive stocks can provide a solid foundation in any investment portfolio. Let’s take a closer look at what makes these stocks so dependable, even when market conditions are far from ideal.

Stable Earnings

One of the defining features of defensive stocks is their ability to generate consistent revenue and earnings, regardless of the economic cycle. Whether the economy is booming or in recession, companies in defensive sectors tend to perform steadily. This is because they offer products or services that consumers need regardless of their financial situation. For instance, utilities, healthcare, and consumer staples industries are known for their stable earnings, as people will always require electricity, healthcare services, and basic household products.

Also read: Earnings Season: Strategies, Insights, and Success in Financial Markets

Low Volatility

Defensive stocks are also known for their lower volatility compared to other types of stocks. While growth stocks or cyclical stocks can experience sharp price swings, defensive stocks typically exhibit more stable price movements. This lower volatility can be reassuring for investors, especially during periods of economic uncertainty. By holding defensive stocks, investors can reduce the overall risk in their portfolios while still maintaining exposure to the stock market.

Examples

When thinking of defensive stocks, industries such as utilities, healthcare, and consumer staples often come to mind. Utility companies, for example, provide essential services like electricity and water, which are always in demand. Healthcare companies, including those producing pharmaceuticals or medical supplies, also fall into this category because healthcare remains a priority regardless of economic conditions. Similarly, consumer staples like food and household goods are consistently needed, making these industries prime examples of defensive stocks.

By focusing on these key characteristics, defensive stocks offer a blend of stability and security, making them a cornerstone of a well-balanced investment portfolio, especially during times of economic uncertainty.

Defensive Stocks Meaning in the Financial Markets

In the complex landscape of financial markets, defensive stocks play a crucial role in portfolio management, particularly for investors seeking protection against volatility. These stocks are known for their ability to maintain stability even when the broader market is in turmoil. The financial markets can be unpredictable, with periods of economic growth followed by downturns or recessions. During these times of uncertainty, defensive stocks stand out as a reliable option.

The key reason behind their consistent performance lies in the nature of the industries they represent. Sectors such as utilities, healthcare, and consumer staples provide products and services that remain in demand regardless of the economic climate. For example, people will continue to need electricity, medication, and basic household goods whether the economy is booming or in a recession. This steady demand translates into more predictable revenues and earnings for companies in these sectors, which in turn supports the value of their stocks.

In bear markets, when most stocks are declining, defensive stocks tend to hold their ground or even gain value. This makes them a preferred choice for investors looking to safeguard their portfolios against significant losses. Moreover, the lower volatility associated with defensive stocks means that they experience fewer dramatic price swings, providing a smoother investment experience. For investors focused on preserving capital, especially during uncertain times, defensive shares offer a measure of security that other stocks may not.

What Are Defense Stocks and How Do They Differ from Defensive Stocks?

It’s easy to confuse defense stocks with defensive stocks due to the similarity in their names, but they represent very different types of investments. Defense stocks are shares in companies that operate within the military and defense industries. These companies manufacture weapons, develop military technology, and provide various services related to national defense. As a result, their performance is closely tied to government defense budgets and geopolitical events. For example, an increase in defense spending or rising global tensions can boost the value of defense stocks, making them more volatile and sensitive to external factors.

Conversely, defensive stocks are associated with stability and consistent performance, regardless of the broader economic or geopolitical environment. These stocks are rooted in industries that supply essential goods and services, making them less susceptible to market fluctuations. While defense stocks may see spikes in value due to specific events, defensive stocks provide a steady return over time, even when other sectors are struggling.

For investors, understanding the difference between these two types of stocks is critical. Defense stocks can offer growth potential tied to specific events, but they also come with higher risk due to their volatility. On the other hand, defensive stocks are ideal for those looking to maintain a balanced and resilient portfolio, particularly during times of economic uncertainty. By distinguishing between defense and defensive stocks, investors can make more informed decisions that align with their financial goals and risk tolerance.

Why Consider Adding Defensive Shares to Your Portfolio?

Adding defensive shares to your portfolio can be a strategic move for both seasoned and novice investors, particularly when it comes to managing risk. In an unpredictable market, defensive stocks act as a buffer against volatility, reducing the overall risk of your investments. Since these stocks are rooted in essential industries like healthcare, utilities, and consumer staples, their performance is less tied to economic cycles. This means that when other sectors may be struggling, defensive stocks continue to generate consistent revenues, helping to stabilize your portfolio.

For long-term investors, defensive stocks provide a reliable foundation for growth. While they may not deliver the same explosive returns as high-growth stocks during a bull market, they offer steady and sustainable returns over time. Many defensive companies also pay regular dividends, providing an additional stream of income that can compound and contribute to long-term wealth accumulation. By including defensive shares in your portfolio, you create a balance between growth potential and risk mitigation, ensuring that your investments are well-positioned to weather economic fluctuations while still moving toward your financial goals.

Also read: Tailored Investments: Leveraging Your Risk Tolerance for Optimal Return

Advantages and Disadvantages of Investing in Defensive Stocks

When considering defensive stocks as part of your investment strategy, it's essential to weigh both their benefits and potential drawbacks. While these stocks are often celebrated for their stability and resilience, especially during economic downturns, they may not be the right fit for every investor or every market condition. Understanding the pros and cons of investing in defensive stocks will help you make a more informed decision about whether they align with your financial goals. Let’s delve into the key advantages and disadvantages of incorporating defensive stocks into your portfolio.

Pros:

- Stability

One of the primary advantages of defensive stocks is their stability. These stocks tend to be less volatile than those in other sectors, providing a more consistent performance regardless of market conditions. This makes them a safe haven during periods of economic uncertainty or market downturns.

- Consistent Dividends

Many defensive stocks are known for paying regular dividends. This can be particularly appealing to income-focused investors, as these dividends provide a steady source of income, which can be reinvested or used as a cash flow.

- Protection During Downturns

Defensive stocks tend to outperform the broader market during recessions or bear markets. Their ability to maintain value, or even appreciate, during challenging economic times offers protection to your overall portfolio.

Cons:

- Lower Growth Potential in Bull Markets

While defensive stocks are reliable during downturns, they often lag behind in bull markets. Their stable, predictable nature means they don't experience the same explosive growth as more cyclical or growth-oriented stocks. Investors seeking rapid capital appreciation may find defensive stocks less appealing during periods of strong economic expansion.

- Less Excitement

For some investors, the slow and steady nature of defensive stocks might seem unexciting. These stocks are unlikely to deliver the kind of spectacular gains that come from riskier investments, making them less attractive for those looking for higher returns in shorter timeframes.

In conclusion, defensive stocks offer a mix of stability and steady income, making them a valuable component of a diversified portfolio. However, it's essential to weigh their advantages against the potential trade-offs, particularly if your investment strategy is focused on high growth during strong market conditions.

Top Examples of Defensive Stocks

When looking for defensive stocks, certain sectors and companies consistently stand out due to their resilience in various economic conditions. These companies provide essential products or services that people rely on, regardless of the market climate, which is why they tend to be more stable during downturns.

Utilities

Companies in the utilities sector, like Duke Energy and Exelon, provide essential services such as electricity, water, and gas. These are necessities that consumers continue to use even during tough economic times, making utilities a classic defensive stock choice.

Healthcare

The healthcare sector, including giants like Johnson & Johnson and Pfizer, is another prime example of defensive stocks. People require medical care and pharmaceuticals regardless of economic conditions, which supports steady revenue for these companies.

Consumer Staples

Companies that produce everyday essentials, such as Procter & Gamble and Coca-Cola, are also considered defensive stocks. These firms offer products that consumers buy regularly, like food, beverages, and household goods, providing consistent earnings even in economic slumps.

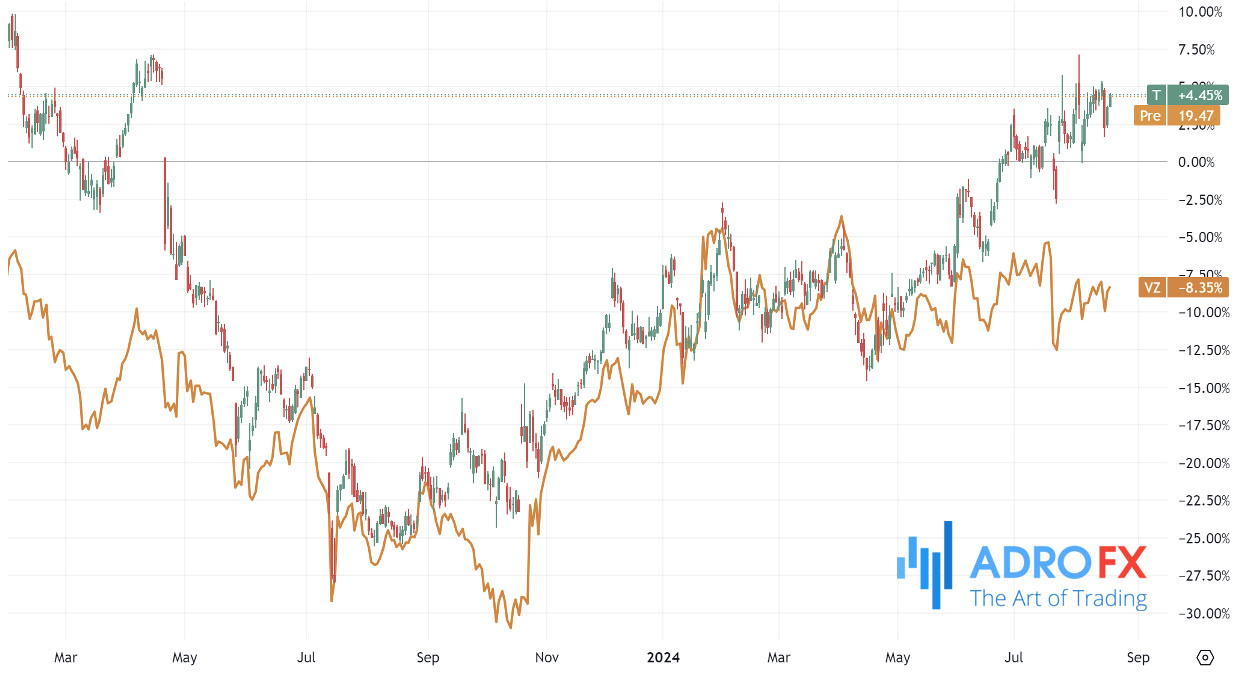

Telecommunications

AT&T and Verizon are examples of defensive stocks in the telecommunications sector. The demand for communication services remains strong, as people continue to rely on mobile and internet services, regardless of economic fluctuations.

Technology Giants

While traditionally seen as growth stocks, tech giants like Apple, Alphabet, and Microsoft have also shown defensive characteristics in recent years. Their massive market share, diversified product lines, and essential services (such as cloud computing and software) have allowed them to maintain stability even during market downturns. Consumers continue to buy smartphones, use search engines, and rely on software and cloud services, making these tech stocks surprisingly resilient.

These companies exemplify the characteristics of defensive stocks, making them solid options for investors seeking stability and steady returns.

Also read: The Transformative Power of Tech Stocks: Opportunities and Insights

Conclusion: Is a Defensive Stock Right for You?

Defensive stocks can be a strategic component of your investment portfolio, particularly if your primary objective is to achieve stability and consistent returns rather than pursuing rapid growth. These stocks, known for their lower volatility and resilience during economic downturns, can offer a sanctuary from the stormy seas of market fluctuations. They typically provide reliable dividends and exhibit less price volatility compared to more cyclical sectors, making them an appealing choice for risk-averse investors.

However, it is important to recognize that defensive stocks might not deliver the same level of capital appreciation as more aggressive investments during periods of economic expansion. Their growth potential tends to be more modest, which means they might underperform compared to high-growth stocks when the market is surging. Therefore, while they play a crucial role in mitigating risk and preserving capital, they may not satisfy those looking for substantial short-term gains.

Before incorporating defensive stocks into your portfolio, thoroughly assess your investment goals, risk tolerance, and time horizon. If you value a balanced approach that can safeguard your investments from market volatility while still providing steady, long-term growth, defensive shares could be a prudent addition. They can serve as a buffer against economic uncertainty, helping to stabilize your overall returns.

Reflect on your current trading strategy and consider how defensive stocks could complement your financial goals. If you're looking to protect your investments from market downturns while maintaining steady returns, trading CFDs on defensive stocks with AdroFx offers a flexible and efficient way to manage risk. Explore the advantages of CFDs and see how defensive shares can enhance your portfolio's resilience. Start trading with AdroFx today and position yourself for more stable and secure returns in any market condition.

About AdroFx

Established in 2018, AdroFx is known for its high technology and its ability to deliver high-quality brokerage services in more than 200 countries around the world. AdroFx makes every effort to keep its customers satisfied and to meet all the trading needs of any trader. With the five types of trading accounts, we have all it takes to fit any traders` needs and styles. The company provides access to 115+ trading instruments, including currencies, metals, stocks, and cryptocurrencies, which make it possible to make the most out of trading on the financial markets. Considering all the above, AdroFx is the perfect variant for anyone who doesn't settle for less than the best.