The Channel Trading – Simple Forex Strategy

If anyone thinks that only supercomplex methods using the best indicators can help traders in their activity on financial markets, they are greatly mistaken.

Practice shows that in most cases successful traders are those who do not chase something new, but use simple, time-tested strategies. We are going to talk about one of such trading strategies today.

This trading system is called channel strategy. This strategy is noteworthy because traders regardless of their experience and time spent in the market can master it and use it in trading.

In addition, the undoubted advantage of the channel strategy is its versatility, which allows its use on different charts with different time ranges.

But first things first. We will try not only to explain the technical side of the matter, connected with the use of this strategy in the market but also get to the bottom of its essence and peculiarities of its application.

What is the Logic Behind Channel Trading?

The forex channel strategy arose from the assumption that the price of assets always moves within a certain price range (channel). Its range depends on price volatility and external and internal factors. But the ability to identify this invisible zone on the chart allows you to determine potential entry and exit points.

The channel strategy may develop as follows: the price of the asset will either rebound from the range boundary and go the opposite direction or break out of the range and form a new trend.

It is common knowledge that the currency market is very dynamic which is evidenced by constant price movement. The price may shift upwards and then change its direction and go down after which it will practically stop and keep growing again.

That is why if we analyze the dynamics of the currency market we will see that the price movements are significantly different in certain time frames. It is conditionally possible to distinguish several types of such movements:

- Trend - a period when price quotes change dynamically in a strictly defined direction.

- Lateral price movement or flat. In this phase, the price practically does not change or fluctuate with insignificant amplitude in a narrow range. This market condition is comparable with the calm when there are no evident preconditions for any sharp price changes.

- The third kind of price movement is characterized by the fact that during a long time interval the price seems to be fixed within certain limits where it is moving. This range is considered to be the corridor of the channel strategy.

How Can We Determine Price Channels?

The following technical indicators are used to visually determine the price range in a particular time frame:

- MACD;

- Fibonacci Retracement;

- RSI.

These technical tools are basic – they are initially built into the trading terminal Metatrader 4:

The price channels are characterized by some established factors. Firstly, all price ranges are straight lines. Also, they are parallel to each other. Only direction (vector), degree of slope, range in pips between the upper and the lower border can change. Secondly, each price channel consists of support and resistance levels. They form a stable price movement vector. And when the candlesticks move out of the range it is possible to say that a new trend is forming. Thirdly, the probability of a candlestick rebound from the support and resistance levels is always higher than the probability of a breakout. These three key factors are the basis of the forex channel strategy.

The principle of channel trading strategy is based on the fact that the price of assets never changes within a few minutes/hours. It takes time for the vector to change dramatically. And there are only three forms of asset price movement: uptrend, downtrend, and flat (when the price moves horizontally, without a dedicated trend). The rate is formed based on the difference between the sales and purchases of the asset. If the High and Low points (the highest price and the lowest price in the range) go down with each closed candle, the trend is a downtrend. If the high and low points increase, the trend is upward. The difference in volumes of trading between the bulls and bears does not allow the market to fall precipitously. Hence the stable rule that after every fall/rise of the price the correlation is performed.

Types of Price Channels

Let's consider all types of price channels:

- Equidistant channelr;

- Fibonacci;

- Linear regression;

- Standard deviation;

- Moving averages shifted along the Y-axis.

The equidistant channel is the most common. Two points are lined up on the chart - maximum and minimum of the price in a certain period of time frame.

Through these points, a line is drawn - the support level and the resistance level, respectively. Between them, at the same distance, a straight line average is drawn.

The Fibonacci channel differs from the above. In addition to the central line, several straight lines are added to the chart at distances of 0.618; 1.0; 1.618, and 2.618 from the average straight line:

The user can add or remove lines from the graph at his discretion, thereby adjusting the accuracy. Such a channel allows one to cover a larger price range and more accurately forecast price movement under certain market conditions.

A linear regression channel differs from an equidistant channel in that support and resistance lines change their position based on the maximum and minimum of the price.

The distance is measured from the center line, which is also built in the range. This technical tool, as well as others, is added to the trading terminal Metatrader for any time frame.

The last two types of channels are used less frequently. They are used mainly for determining the mood of the markets. Because the distance between the center and the boundary lines depends on the difference between the closing and opening price of the candles.

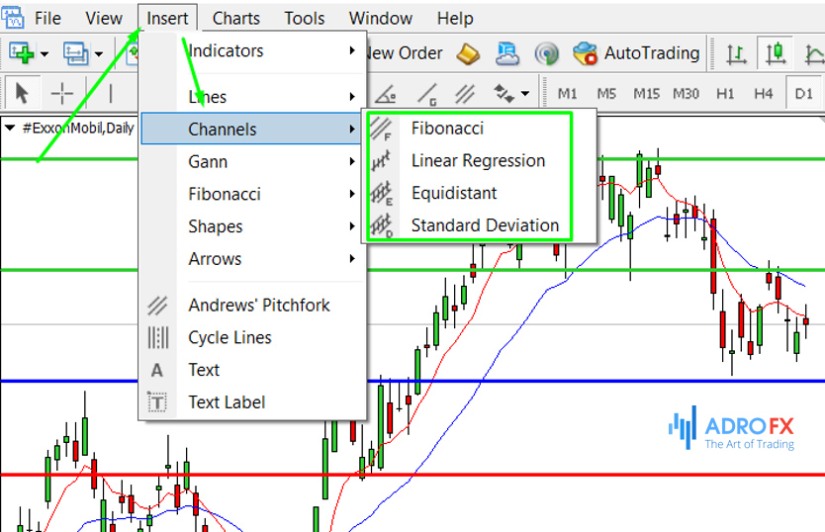

To add one or another indicator of the market sentiment, you should go to the menu "Insert" - "Channels", and select the necessary tool.

Forecasting Price Movements Using the Channel Strategy

Despite the theoretical simplicity of working with the Forex channel strategy, most newbies have a number of difficulties. Many people perceive a signal to place a sell order when a candle touches the upper boundary of the price channel. But this is not entirely correct. Neither is the fact that a candle leaving the position of a straight line is a signal for the subsequent breakout.

The easiest way to predict a channel is to wait for the candle to close near support or resistance. If it does not touch a straight line, it should not be considered by the trader. It takes anywhere from 2 to 5 candles for the price to reverse on a correlation at a support or resistance level. This should be taken into account when you open trades on the reversal at the border of the channel.

When predicting asset price movements using the described forex strategy, you should consider the position of the average guide. If the candle crosses it from bottom to top and is fixed, it is a signal for an upward trend. If the opposite is the case - a downward trend with the possibility of future correlation.

Some traders try to use the channel strategy in scalping by opening orders with short expiration time on the bounces. But in fact, the amount of false trade signals and lack of ability to predict the trend reversal cycle on the border (from 2 to 5 candles) negates the chance of a permanent and stable profit. Therefore, it is rational to use Stop Loss and Take Profit levels during trading.

Tips for Applying the Price Channels Strategy

Forex forecasting based on price channels cannot be called a full-fledged trading strategy. After all, it is necessary to use other methods to increase accuracy. For example, it is necessary to carry out a fundamental analysis and trace the influence of external factors on the behavior of asset prices.

There are several disadvantages of the described forecasting methodology:

- At least a quarter/third of the signals are false;

- The difficulty in determining the best moment to enter the market for beginners;

- A small number of signals in high time frames, when the price often fluctuates within a range without touching the boundaries.

It is important to remember such a nuance as time frame. After all, in a five-minute time frame, the price may be moving in an uptrend, but in an hourly time frame, we will see that it is only a temporary bounce in the global downtrend. It is impossible to fully develop without understanding the basics of the channel strategy. But it is also necessary to work with it carefully according to the basic principles, to use the fundamental analysis, take into account the global and temporary trend factors, and study the charts on several timeframes at once.

That's why most often experienced traders use channels when forecasting price movements of assets during flat periods. At such moments, it is easier to predict the moment of rebound and it is more probable. In pronounced trends, it is difficult to determine where the rebound will occur and whether it will happen at all. Because the impulse of candlesticks can be too great, which will lead to a sharp change of the channel vector and completely nullify the chances of a profitable order that was opened earlier.

About AdroFx

Established in 2018, AdroFx is known for its high technology and its ability to deliver high-quality brokerage services in more than 200 countries around the world. AdroFx makes every effort to keep its customers satisfied and to meet all the trading needs of any trader. With the five types of trading accounts, we have all it takes to fit any traders` needs and styles. The company provides access to 115+ trading instruments, including currencies, metals, stocks, and cryptocurrencies, which make it possible to make the most out of trading on the financial markets. Considering all the above, AdroFx is the perfect variant for anyone who doesn't settle for less than the best.