Best Forex Indicators for Intraday Trading

Forex indicators - various tools of technical analysis of the situation in the world currency market. These are special tools that facilitate the planning of intraday trading on the market, as planning in these conditions is difficult. Short-term trading is characterized by the fact that all trades within the strategy must be completed during the business day and cannot be rolled over. The main characteristic is a responsive reaction to rapid market changes. Each piece of news immediately affects the quotes, so new information should be used immediately. Profits, as well as losses, occur very quickly.

Best Forex Indicators for Intraday Trading

Forex beginners should study the indicators - special programs, designed to help traders. Here are the best forex indicators for intraday trading, which are the easiest to understand. They are used for technical analysis and drawing up forecasts, as well as allow making trading decisions more orderly.

There are a lot of such programs and they are divided into several categories:

- Trend-following ones are designed for a pronounced trend and are useless in a flat condition;

- Oscillators are called flat ones and are useful in flat movements and weak trends;

- Volume indicators - thanks to statistics they allow you to interpret the moods of participants in the currency pairs market.

Experts do not recommend using more than 2-3 indicators simultaneously. There are many analysis tools, let us name the most understandable and convenient for beginners indicators for intraday trading: ADX crossing, Stochastic, and RSI. Perhaps their popularity can be explained by the fact that these indicators are preinstalled in popular trading platforms of the largest forex brokers.

ADX Crossing

ADX crossing is a trend indicator from the ADX (Average Directional Index) family and shows the strength of price movements.

Graphically, it is expressed as a green circle (a signal to buy) or red (which shows that it is necessary to sell). This indicator works well for scalping.

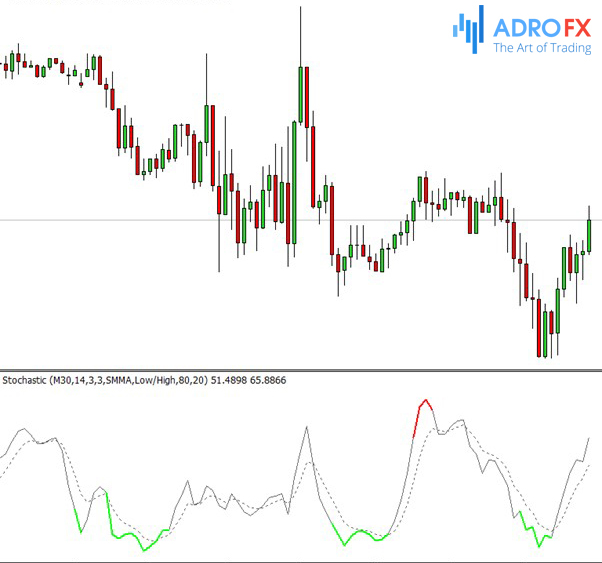

Stochastic Oscillator

The classic indicator is the Stochastic Oscillator, used to determine the current closing price position, the averaging period is chosen by a trader. It is convenient for short-term trading, as it is more precise thanks to the consideration of maximums and minimums.

It gives the most accurate results in the sideways section of the price. It is recommended to use it along with the trend indicator in the trend sections.

RSI

RSI works well together with the Stochastic and complements it. It helps to open positions, taking into account the overbought or oversold market. It does not help to determine how long the current trend will last.

Stochastic RSI

For intraday trading is very convenient to use such an analysis tool, as the Stochastic RSI, developed based on the above-mentioned indicators. It is characterized by high sensitivity and reliability.

Color Stochastic

The Color Stochastic indicator is another development based on the popular tool. It shows if the market is oversold or overbought and helps to identify reversal patterns. Indicates entry and closing points.

Trading Strategies for Short-Term and Intraday Trading

Traders use about a dozen trading strategies for short-term and intraday trading. It is difficult for beginners to keep up with the rapid market changes, which is why experienced brokers recommend using indicators for better orientation in margin trading. Such trades are connected with increased risk. To avoid losses, it is necessary to pay special attention to technical analysis.

As an example, several intraday trading strategies use highly liquid assets and operate within the lowest time frame possible. They can be universal or specific. The universal ones are applicable in any time frame, while the specific ones are designed for the time frames from M5 to M30. Trading strategies for short-term and intraday trading can be called the easiest to master:

- From horizontal levels;

- From the morning flat breakout;

- Scalping;

- News trading.

Trading from Horizontal Support and Resistance Levels

This is a universal strategy, which works well in M15 and M30 time frames. Initially, the horizontal level is selected with the support of 2 local extrema, taking into account the selected time frames. The probability to earn is higher during the Asian session.

Trading is conducted in two directions: on the breakout of the level and the rebound.

After the level is broken out, one waits for the price to return to its previous values, and then enters the market. If the price has pushed away from the level, they wait for the first candle, marked after the rebound, to be broken out. After 3-5 local extrema the probability of breaking out the level increases and the probability of formation of maximum and minimum decreases.

On the nearest price peak outside the horizontal S/R level, a Stop Loss should be placed. These are pending orders that will be automatically triggered if the price passes the designated level. It is possible to use the nearest local maximums. It is required to estimate the planned losses, the size of Take Profit depends on them. It should be greater than the amount of losses.

Trading Morning Flat Breakout

Positions called morning flat breakout trading are typical for the Asian session. The price movement stays within a narrow corridor. Currency pairs are actively traded at European and American sessions. It is necessary to build a trading strategy focused on impulse changes of the currency pair, which occur at the exit from the range of the Asian market.

The use of the I-sessions indicator helps traders. The tool should be downloaded and installed to see the highlighted periods on the charts of different sessions. It is necessary to enter the market after the closing of the final candle in the Asian session. In the beginning, the pending orders should be placed outside the limits of the range. Then, after the triggering of the first order, a stop loss is placed in place of the second order.

If the movement is strong, the order is closed in parts, and it is possible to use the Trading Stop. The orders that are not closed during one day should be closed manually before leaving the trade to prevent losses.

Scalping

Scalping implies setting a certain threshold for closing a position. It is necessary to constantly monitor the situation and make quick decisions. Setting a Stop Loss on a position that is as close to the price of an asset as possible allows you to maximize profits. The rule of thumb for losses is to close the position when the trend moves 5 pips. It is recommended to enter the market when the trend is moving steadily, afterwards the position is closed if the trend changes its direction.

For intraday scalping trading, it is advisable to choose assets with high liquidity and strong trends. Also, these may be options or cryptocurrencies with high volatility. During the day it is necessary to have time to earn on high fluctuations. If the price has passed the average range of the move during the day, it is no longer worthwhile to enter the market.

News Trading

For successful news trading, it is necessary to be aware of all financial and economic changes in the market. If a trend depends on them, it is necessary to find out about any changes as soon as possible.

A trader can use the calendar of significant events and consider special tables of their influence on asset rates (for example, currencies) on the stock market. It is necessary to trace the trends in the higher time frames. More complex strategies require deep knowledge of the market and its development mechanisms.

About AdroFx

Established in 2018, AdroFx is known for its high technology and its ability to deliver high-quality brokerage services in more than 200 countries around the world. AdroFx makes every effort to keep its customers satisfied and to meet all the trading needs of any trader. With the five types of trading accounts, we have all it takes to fit any traders` needs and styles. The company provides access to 115+ trading instruments, including currencies, metals, stocks, and cryptocurrencies, which make it possible to make the most out of trading on the financial markets. Considering all the above, AdroFx is the perfect variant for anyone who doesn't settle for less than the best.