Awesome Oscillator - Tutorial on Using the Indicator

Right before opening trades on the forex market, every trader carries out a technical analysis of the chart. It is necessary to find the most profitable market entry points and use them most effectively. In fact, at this stage, the user sets a vector for all their future actions. Using the information obtained in market analysis, the user can choose the best trading strategies and ways to implement them.

However, due to the specificity of financial markets, all technical indicators can periodically generate false readings, the use of which brings losses to the user. The effectiveness of a tool is often measured not only by its profitability but also by the number of false signals: the fewer of them, the better indicator. Not every algorithm is profitable, and some others bring only losses.

The problem of choosing a trading instrument is very important to modern traders because it is easy to find a huge number of different indicators, but it is very difficult to choose among them really profitable and convenient. In this case, it is recommended to pay attention first of all to classic trading tools. This article will consider one of them - the Awesome oscillator indicator.

How Does Awesome Oscillator Work?

The Awesome Oscillator indicator is a histogram similar to the MACD indicator, which shows the market momentum of the last number of periods compared to the momentum of previous periods.

The formula for calculating the indicator compares two Moving Averages, one short-term and one long-term. The comparison of two different periods is quite common for a number of technical indicators. However, for Awesome Oscillator, Moving Averages are calculated using the average value of candlesticks instead of the closing price.

Williams wrote in his book: "This is, without a doubt, the best momentum indicator available for stock and commodities markets. It is as simple as it is elegant. It is essentially a simple 34-bar Moving Average subtracted from a simple 5-bar Moving Average."

However, you are free to use any periods that suit you.

A positive indicator value means that the fast period is higher than the slow one, and vice versa, a negative value occurs when the fast period is lower than the slow one.

The Logic Behind AO Indicator

The method of calculation of the AO indicator is very simple - it is enough to calculate the difference of Moving Averages of the typical price with periods 34 and 5.

AO = EMA(34) - EMA(5), where:

EMA (34) - slow Exponential Moving Average with a period of 34 (the basic version of the indicator uses a Simple Moving Average, but, as a rule, the exponential one works smoother);

EMA (5) - fast Exponential Moving Average with a period of 5 (the basic version of the indicator uses a Simple Moving Average, but the exponential one is smoother, as a rule).

It is considered that the slow EMA shows the trend with its slope, while the fast EMA shows the direction of price fluctuations within the trend and gives an idea of the market driving force.

When the price is moving along the trend, the AO is moving away from the 0 value, showing that the trend is full of strength. When the price begins to correct, the AO begins to approach 0, indicating that a corrective movement is beginning. If the fast and slow EMAs cross (the AO indicator crosses the 0 level), this position indicates a change in the dominant trading group. If the price forms a new extremum within the trend, and AO duplicates this extremum update, the trend is safe. But if the price forms a new extremum not confirmed by the indicator, the situation indicates that the trend is weakening and its reversal is possible in the nearest future.

How to Set Up the Awesome Oscillator

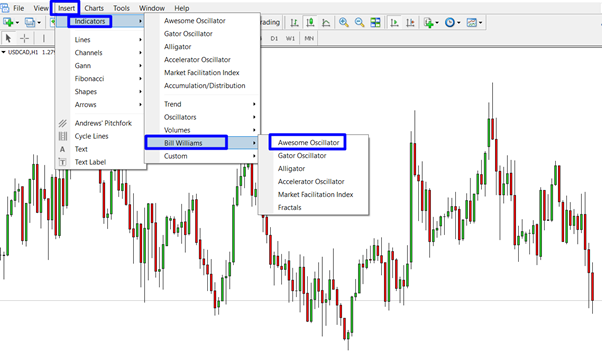

Before searching for potential opportunities to enter the market, a trader will need to install the tool on the working chart. Since it is standard for most trading platforms, the user will not have to search for it on the Internet and download it manually. It will be enough just to open the trading client and perform the following actions:

- First, on the work panel, you need to find the "Insert" menu;

- Then the user will need to go to the "Indicators" section;

- In this section, it will be possible to find a sub-item called "Bill Williams", which contains the necessary indicator;

- Having found the desired tool, the user only needs to transfer it to the price chart using the mouse.

Immediately after that, the trader will see a window with the tool settings. As stated above, it is impossible to change any functional parameters of the indicator: unlike most other oscillators, this algorithm does not imply changing the periods of working lines used for calculating all basic indicators.

The only thing the user can change is the appearance of the tool. In the settings menu, one can find parameters responsible for the thickness of the generated lines, as well as the coloring of the indicator working elements - moving averages and histogram bars. Thus, a trader can optimize the tool to aesthetic preferences and make the indicator readings more perceptible.

It should also be noted that apart from the histogram and Moving Average lines, this oscillator offers a user to display levels limiting areas with a large number of buy or sell orders on the chart. You can activate or deactivate them using the appropriate parameter, which can be found in the "Levels" tab. The user can select the values for these horizontal lines himself.

Trading Strategies on the Basis of Awesome Oscillator

Awesome Oscillator is a universal oscillator, and many forex trading strategies are based on it. First, it is used on its own, without any additional indicators. Trading is based on signals and peculiar graphical figures, which appear on the histogram of the oscillator.

One of such patterns is the "double top". The signal for the long position will be a double minimum, formed below the zero level. But the order is placed after the formation of at least two columns of the same color, showing the reversal of the upward trend.

A sell order is placed after the formation of two peaks above the zero level, after the formation of two columns of the same color, showing the reversal of the trend to the downward. The "double top" shown by Awesome Oscillator, in this case, is analogous to the classic graphical figures of "double top" and "double bottom".

Another standard strategy for Awesome Oscillator is a corrective, Saucer. The buy order is set when the bars of the histogram, showing the downtrend, reach the zero level, but cannot overcome it, and the growth starts. To implement the strategy, the two bars colored in green have to show the transition to the uptrend.

The third classic Awesome Oscillator strategy implies its ability to detect divergences. It is also possible to realize the strategy with just one Awesome Oscillator, but two additional levels should be added to the settings, one above the zero line and one below it.

The signal to buy will be a placement of AO above the new line level, in this case, 0.005, after two red bars appear. The oscillator below -0.005 and the appearance of two green bars is a signal to sell.

This strategy is developed by Bill Williams who recommended placing the Fibonacci Retracement on the chart along with the highs and lows of the period from the oscillator zero crossing to the appearance of bars in order to increase the trading precision.

Awesome Oscillator is often used with other Bill Williams indicators. For example, with Accelerator Oscillator, which is designed to determine the speed of price movement.

There is one strategy that is based on the Awesome Oscillator signals, which should help to determine entry points into trades. The Accelerator Oscillator confirms the direction and strength of the trend.

The signal to buy is when the AO indicator crosses the zero level from bottom to top and a green column appears. At the same time, Accelerator Oscillator should also show green color and be placed above the average line. The signal for selling is the downward crossover of AO and the appearance of a red column. Accordingly, the Accelerator Oscillator is below the middle line and a red column appears.

This strategy can be complemented by the classic Parabolic SAR indicator, which confirms the trend and makes it easier to find exit points from the forex market.

Another strategy with the Awesome Oscillator indicator is called "MACD Profitunity". It uses AO, MACD, and Williams' Fractals" indicator. As a reminder, the Fractals indicator shows the minimums and maximums over a certain period, which are identified on the chart by arrows of different colors.

The MACD is set with a fast EMA of 34, a slow EMA of 89, and an SMA of 9. An uptrend is determined by placing the MACD above the line, Awesome Oscillator forms a relevant pattern, - Saucer or zero line crossing. Fractals are needed to determine the location of a Stop Loss, which should be set at the level of the last fractal below the chart. These are signals for buying. The sell signals for this strategy will be mirror signals.

This strategy in its original version was developed by B. Williams himself; he used his own indicator, the Alligator. But with Alligator and MACD this strategy is difficult to understand and implement, that is why it is not recommended for beginners.

The other strategy uses Exponential Moving Average together with an Awesome Oscillator. Here we are supposed to work with EMA with period 200, Awesome Oscillator is used with standard settings.

The signal for placing a long position will be crossing of zero level of AO from the bottom up and the appearance of a green column above the line, the price should be above the EMA. The signal to sell will be a downward crossover of zero level of AO and with the occurrence of a red bar below the zero line, the price should be below the EMA. It is recommended to implement the strategy in the time frame of 1 hour.

More advanced version of the strategy for implementation in the M30 time frame - three exponential curves with different periods - 10, 40, and 150, as well as an Awesome Oscillator with standard settings. According to this strategy, a buy signal will be sent if the EMA curve appears in the order of 10>40>150, and the Awesome Oscillator column appears in green color above the zero line. Correspondingly, a sell signal is formed when the Exponential Moving Average lines up in the order 150>40>10 and the Awesome Oscillator column of red color appears below zero level.

There is a strategy where Parabolic SAR, Moving Average and Awesome Oscillator is used, in the M30 time frame. Parabolic SAR settings - 0.01 to 0.1 step, MA with a period of 5, Awesome Oscillator with standard settings. As a signal to buy Parabolic will be placed below the price, AO column - green above zero level, the corresponding candle should close above the EMA.

As a signal to sell Parabolic is above the price, AO is below zero level, the bar is red, and the corresponding candlestick should close below the EMA.

Awesome Oscillator is used in combination with the Bollinger Bands. Recall, Bollinger Bands is a fairly popular indicator among the tools developed by the famous trader John Bollinger, which is included in the list of standard trading terminals. This indicator is designed to determine, in particular, the direction of price movement and its speed.

In the strategy under consideration, the Awesome Oscillator indicator is set with standard settings. The Bollinger Bands indicator with a period of 20 and deviation of 3 by close price is used. The EMA with a period of 3 is also set.

The signal to buy is the crossing of the average Bollinger Bands line of Moving Average from the bottom up, and the green column of AO above the zero mark appears. The signal to sell, respectively, is a top-down crossing of the average Bollinger Bands Moving Average line with the formation of a red column below the zero level.

Conclusion

To sum up, we can say that the classic Awesome Oscillator indicator is a very effective tool, which can bring a trader a lot of income. You can't call it "marvelous", but it is really effective and handy. Also, interested users should pay attention to some modifications of the tool, which greatly improve it and make it even more profitable to trade on its readings

.