5 Key Dates to Mark on Your Calendar | Daily Market Analysis

Key events:

- UK – Composite PMI (Feb)

- UK – Services PMI (Feb)

- USA – ISM Non-Manufacturing PMI (Feb)

The U.S. stock market ended February uncertain, leaving investors questioning whether the rally seen earlier this year will continue.

After a strong January, the Dow Jones Industrial Average fell 4.2% in February. For the rest of the year, the blue-chip index shows a decline of 1.5%.

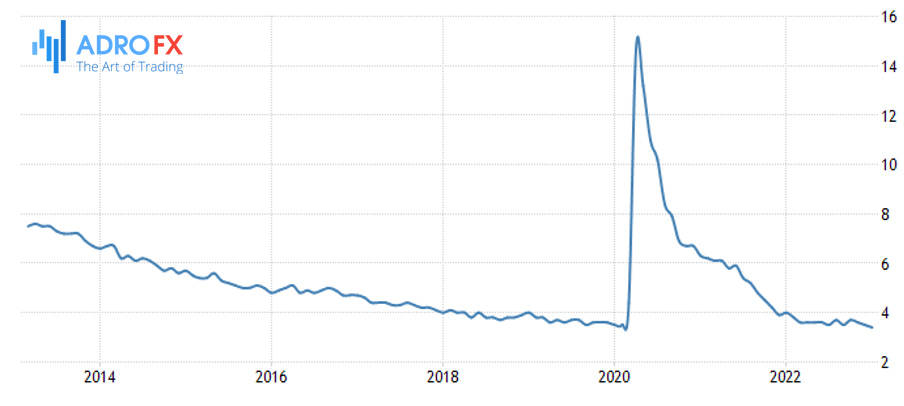

Cracks appeared in the early-year rally after investors were forced to reconsider their expectations of how high the Fed would raise its interest rates, amid signs of a resilient economy and continued high inflation.

The month ahead promises to be one of the most important for Wall Street in years. A string of high-profile March events could determine the direction of the market for the rest of 2023.

Market participants will likely be watching for the same drivers in March as in recent months, including the monthly jobs report, fresh inflation and retail sales data, and the upcoming FOMC meeting.

- Friday, March 10: Employment Report

The U.S. Department of Labor will release the long-awaited Non-Farm Payrolls data for February on Friday, March 10. Most forecasts point to continued strong job growth, despite a slight slowdown from previous months.

The consensus forecast calls for an increase of 200,000 jobs in the U.S. economy after rising by 517,000 in January. The unemployment rate is projected to rise to 3.5%, up one-tenth of a percentage point from January's 53-year low of 3.4% (the last time unemployment was this low was in 1969).

To be clear, exactly one year ago, in February 2022, unemployment was 3.8%. This suggests that the Fed will need additional rate hikes to "cool down" the labor market.

Fed policymakers have signaled that unemployment needs to be at least 4.0% to slow inflation, while some economists are talking about even higher levels. In any case, low unemployment along with strong job growth indicates the likelihood of more rate hikes in the coming months.

- Tuesday, March 14: CPI

The consumer price index (CPI) for February is expected on Tuesday, March 14, and analysts expect the figure may exceed January's value, which means the Fed will continue to fight inflation. The annual inflation rate in January was 6.4%.

Although there are no official forecasts yet, the annual CPI is expected to be between 6.1% and 6.5%. Consumer price inflation peaked in June at 9.1% and has been gradually declining since then, though it remains well above levels consistent with the Fed's 2% target.

Meanwhile, estimates for core CPI range from 5.5% to 5.7%, down from January's 5.6%. The benchmark figure is closely watched by many observers, including Fed policymakers, who believe it provides a more accurate indication of the future direction of inflation.

- Wednesday, March 15: Producer Price Index and Retail Sales

With the Fed's decisions depending on macro data, market participants will pay close attention to February's Producer Price Index and fresh Retail Sales data to be released on Wednesday, March 15.

This time, the data will be especially important because it will be the last of the statistics the Fed gets before it makes a rate decision.

Last month the stock market responded with a strong sell-off to the release of Producer Price and Retail Sales data. They signaled a stronger-than-expected increase in wholesale prices and the sharpest increase in retail sales in nearly two years from the previous month.

- Wednesday, March 22: Fed Meeting and Powell Speech

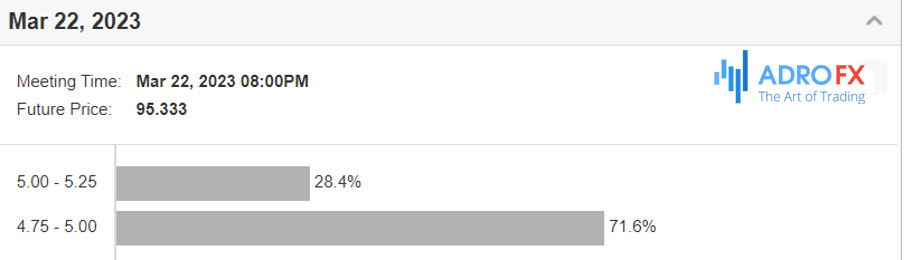

The Fed will almost certainly raise rates by a quarter percentage point at the end of its two-day meeting. The decision will be announced on Wednesday, March 22. In that case, the target range for the Fed funds rate would be 4.75-5.00%.

At the same time, traders have started pricing in a 50 basis point chance of a Fed funds rate hike, though it's only estimated at about 25%.

Chairman Jerome Powell will speak at a press conference shortly after the Fed statement is released. Investors will be interested in how he assesses inflation and economic growth trends and what that means in terms of the pace of monetary policy tightening.

The U.S. central bank will also release updated forecasts for interest rates and economic growth, which will also help judge the likely trajectory of rates for the remainder of 2023 and beyond.

Over the past two weeks, traders began to price in a much higher federal funds rate after positive economic indicators reinforced expectations among investors that the Fed would continue to raise borrowing costs through the summer and then hold rates at high levels longer. Market participants currently expect the key rate to peak in the 5.25-5.50% range by June.

- Friday, March 31: PCE

The last economic indicator of the month is Friday, March 31, when the government will release the Personal Consumption Expenditures Price Index (PCE), the Fed's preferred measure of inflation.

Investors were in shock last month after January's data showed the PCE jumped to 5.4% from 5.3% the month before.

The U.S. stock market will remain under pressure through March due to fears of longer-term high rates and accelerating inflation.

Until we get conclusive evidence that inflation is declining toward acceptable levels and the Fed has clearly changed course, a new sustained bull market in risky assets is unlikely.