How to Read Forex Charts: Graphical Analysis of the Market

The value of assets changes every second and this process can be represented in the form of a chart, and on the basis of the accumulated statistical data, it is possible to assume with a higher probability the forthcoming price movement. What are the graphical patterns and which tools are the most effective and popular among successful traders? Today we will talk about graphical analysis, its advantages, and stages.

What is Graphical Analysis?

Modern traders have a variety of technical means at their disposal to fix trading results and price changes: the functionality of the trading platform on the broker's website, special software, etc. Basically, graphical analysis is a combination of methods and tools used to interpret information.

The trader compares the current price dynamics of an asset to a set of available classical models. And if the price movement resembles one of the models, then it can be assumed that the price of the asset at the next moment will change exactly as it usually does following this model.

Fundamentals of the Graphical Analysis

Calculations are made based on the changes in the value of the asset, and fundamental analysis, information flow, and indicators are usually not taken into account in the forex graphical analysis. It is considered that all information necessary for successful trading is already discounted in the chart. The task of the trader - on the basis of observation of price change dynamics to identify certain recurring patterns, which signal whether the trend will change in the next moment, or remain the same. The trader interprets the changes on the chart independently, as there are no unambiguous, generally accepted criteria for all.

How Does the Graphical Analysis Work?

Using graphical analysis, the trader collects and studies the statistics of previously executed trades to make assumptions about the behavior of prices in the future.

There are two methods of working with the graphical analysis:

- Using a chart as a moving object, and looking for points of support or price reversal.

- They look for patterns that are formed on the chart.

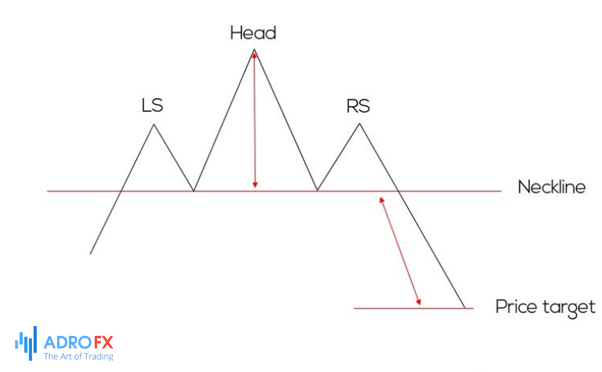

For example, analysts have long identified the most common patterns on charts. When it comes to Forex chart patterns, first of all, we talk about the classic figure "Head and shoulders". Based on it, we can judge the imminent reversal of the market.

If we take the situation when the price corresponds to the descending trend line as an example, then during the correction the price comes to it, bounces, and continues to move along with the trend. Sellers are waiting for the most favorable moment to sell the asset at a higher earnings. The number of buyers increases. This entails a decrease in the amount of the asset. The price reaches the trend line. This is when sellers enter the market, and the supply of the asset increases sharply. This continues until supply and demand are balanced. Then the amount of supply continues to increase, and the chart shows that the breakout of the trend line was false.

Forecasts based on graphical analysis come true when all market participants act in the same direction. The technical analysis calls such forecasts self-fulfilling.

Basic Chart Patterns

The price on the forex chart forms various geometric shapes. They are divided into:

- trend reversal patterns;

- continuation patterns.

Reversal Patterns

Reversal models show the weakening of the trend and the probability of a price reversal. If prices have been rising, during this reversal phase the balance between the buying and selling levels more or less evens out. This continues until the value of sales pushes the trend down. When the market stops falling, a reversal occurs.

The main reversal models are:

Head and shoulders. Visually - two shoulders and a head between them. It occurs more often than other figures. First, one peak appears on the chart, then the second one is higher than the first one, then the third one appears approximately at the level of the first peak.

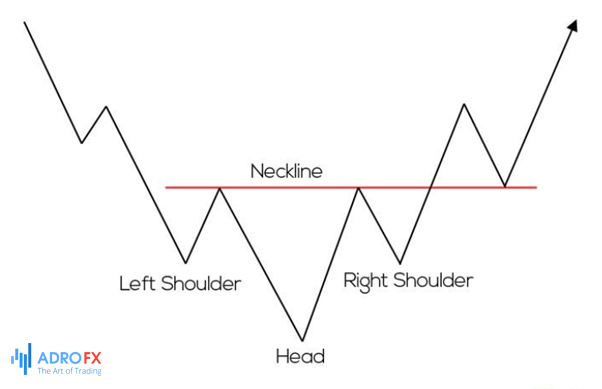

Inverse head and shoulders – the opposite pattern from the previous one.

Double top. The shape of the pattern is similar to the letter "M". It appears when the uptrend is coming to an end.

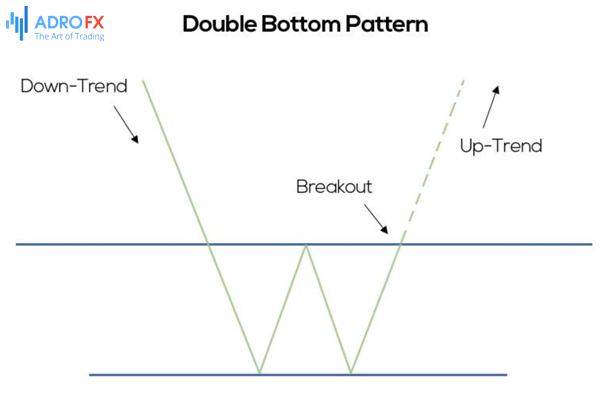

Double bottom. If the downward movement ends, a pattern resembling the letter "W" appears.

Continuation Patterns

These patterns are formed on the chart during the price movement in M15-H4 time frames. If a trader sees these patterns, it means that the market is likely to maintain its direction of movement.

Major patterns are:

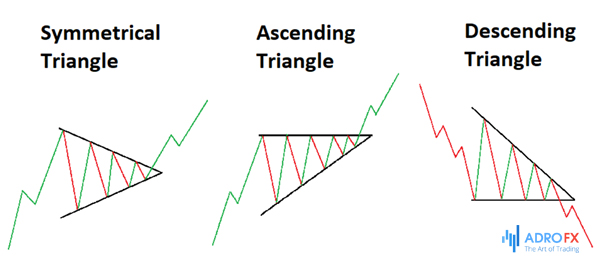

Triangle – ascending, descending, symmetrical. The upper edge of the ascending triangle is almost horizontal and the lower edge is an ascending straight line. The chart shows consecutively increasing lows. The range of price movement is narrowing. The pattern of the descending triangle is reversed. The symmetrical triangle shows that the market is in balance. It is necessary to open a trade when the level of support or resistance is broken out.

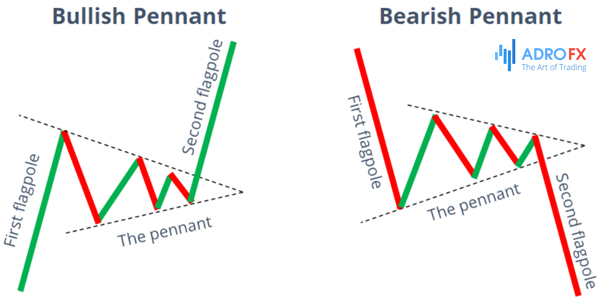

Pennant. Lines of resistance and support come close, forming a triangle with a pronounced acute angle. This pattern will be useful if the trader missed the beginning of a move but is going to catch part of the remaining trend.

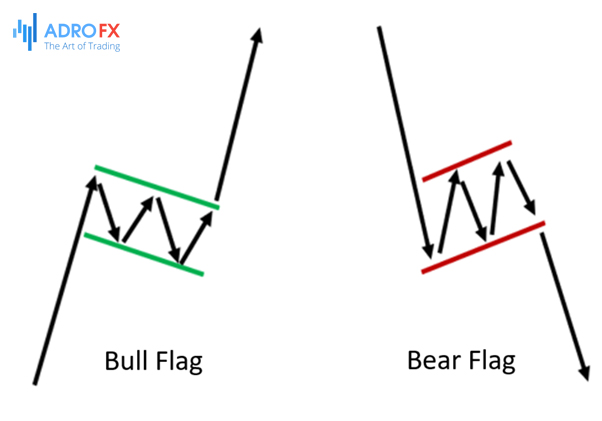

Flag. A flag and its special cases are price channels. It is formed by two parallel lines. If the price moves within a horizontal price channel, it means that the market is flat. The sloping channel shows that the trend is upward or downward. The entry point should be chosen upon breakout of one of the flag`s borders.

Graphical Analysis Tools

In the digitization of market data displayed in graphical format, tools are used that are aimed at interpreting the chart itself. The basics of graphical analysis involve the use of several of the most popular tools in trading:

Line. The maximum or minimum levels of quotes are connected by the line to determine the price level, from which the asset will rebound in the opposite direction. Besides, the line is used for forming the channel of price fluctuation;

Rectangle. A trader can identify certain market periods, characterized by the attenuation of the amplitude of fluctuations. Thus the trader predicts the moment when the price breaks out;

Fibonacci retracement. Thanks to this tool it is possible to use the moment of a quote reversal of this or that asset.

Pitchfork. It is used to calculate the extremums of the market, as well as the average value of the asset.

Forex Graphical Analysis Tools

Professional traders agree that charts are also an important tool to display the dynamics of asset price changes. There are three most common:

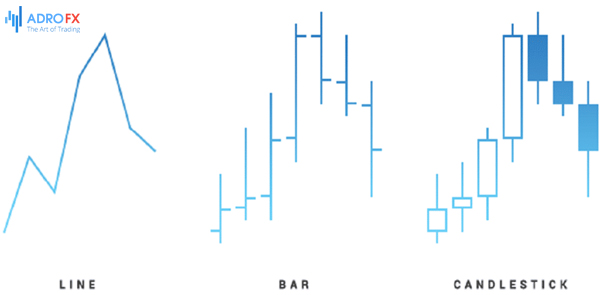

Bar chart – gives information about the amount of the transaction, as well as the opening and closing price. An optimal choice if you want to display the dynamics of price changes over a long period;

Candlestick chart – the chart is represented as rectangles, top and bottom lines correspond to the opening and closing prices;

Line chart – the least popular and simplified method of displaying, the essence of which is to clear the chart of unimportant "noise", focusing attention on the main trend.

Graphical analysis and corresponding tools enlarge the analytical possibilities of a trader, as they imply rather deep learning and also a share of improvisation in forex trading. Mastering at least a few strategies usually leads to a significant improvement in trading results.

Stages of the Graphical Analysis

To make a qualitative graphical analysis of the forex market it is necessary to successively fulfill several steps:

Identify points on the chart, in which the price of the asset reaches its minimum and maximum values - extrema.

They can be local and global. Data for a certain period and plotted on the chart, taking into account various indicators.

Draw the trend line. To do this, draw a straight line that connects two extrema. Through low extrema, it will be the support line, through high ones – the resistance line. Straight lines passing through the local extrema will be auxiliary lines that will show additional movement parameters.

Identification of breakout points of technical lines. It will allow for determining the moments of a possible trend reversal. Breakout can be false when the trend keeps moving in the same direction.

When the breakout is true, the trend reverses. This can be seen by two candlesticks that close above or below the trend line.

The Main Advantages of the Graphical Analysis

- The trader's task is to generate income by making forecasts, no matter what method is used.

- Experienced traders single out several advantages of chart analysis:

- It is easy to learn - it is enough to memorize figures and use them correctly.

- Unambiguity of interpretation. Each chart pattern has its own scenario for future developments. Graphical analysis, as well as other trading strategies, do not give 100% confidence in the correct interpretation of the information obtained. For this purpose, traders apply the principle of capital management in order not to lose their deposits.

- Optimal risk/reward ratio.

- Availability of method. It is not necessary to install additional programs, buy indicators, or use commercial terminals, it is just necessary to use a price chart.

- Versatility. It is possible to use the graphical analysis not only for forex trading but also for commodities and stock markets, etc.

Conclusion

It is recommended for beginners to start mastering trading namely with the graphical analysis of the market and study what charts exist and what they look like. The strategy based on graphical analysis is quite reliable and allows almost no errors in guessing the price movement direction.

As time passes and the trader gains experience and confidence in their actions, it is possible to use additional tools to enter the trades more precisely.

About AdroFx

Established in 2018, AdroFx is known for its high technology and its ability to deliver high-quality brokerage services in more than 200 countries around the world. AdroFx makes every effort to keep its customers satisfied and to meet all the trading needs of any trader. With the five types of trading accounts, we have all it takes to fit any traders` needs and styles. The company provides access to 115+ trading instruments, including currencies, metals, stocks, and cryptocurrencies, which make it possible to make the most out of trading on the financial markets. Considering all the above, AdroFx is the perfect variant for anyone who doesn't settle for less than the best.