A Trader's Guide to Using Fractals

The fractal indicator was created by the famous trader Bill Williams. It can be used in isolation or together with other indicators. He is considered one of the progenitors of modern trading psychology. Back in the 1980s, he put forward the Chaos Theory, which offered a methodological understanding of market structures. He combined trading psychology with applied technical analysis and developed a trading system that was ahead of its time. Even today both retail and institutional traders consider Chaos Theory and the Alligator trading system as one of the most profitable trading systems.

Following his chaos theory, Williams developed some technical indicators. And today we will consider one of them, namely fractals.

Description of the Fractal Indicator

Among the tools of technical analysis for forex trading, Bill Williams' fractal indicator takes a special place, as it is based on a special market theory, the fractal. A brief theoretical excursus is necessary in this case. The fractal theory is based on two simple, in fact, operations: copying and scaling. The term "fractal" itself has no strict definition, but it has one key characteristic - self-similarity.

That is, it's a certain number of objects, each of which looks like a set as a whole, for example, a branching tree in which each branch with branches looks visually like the whole tree. Fractals are all around us; almost all social, political, and economic phenomena are fractal - repeating at different scales. Fluctuations in asset prices are also fractals.

The creator of the fractal theory was French mathematician Benoit Mandelbrot. He also drew attention to the fact that fractal patterns can be traced in stock trading. One day he applied daily price fluctuations to fluctuations of a longer period and found out that they were similar. It is this similarity that makes it possible to predict the future price behavior of an asset.

Over time, the fractal theory has gained many supporters. The fact is that it turned out to be the only one pretending to have a practical justification of the market theory. Before fractals it was considered that there were many objects on the market which reacted to certain events and were corrected by counteractions, i.e., the system was in constant equilibrium (the whole truth about forex). But research back in the 50s. of the 20th century showed that the model of random corrected fluctuations is not always confirmed empirically and strong price fluctuations happen too often. It was Mandelbrot who questioned the theory of random fluctuations and offered his explanation.

Bill Williams Fractals

Bill Williams, the famous trader who created several very popular indicators for forex, based his indicator on the fractal theory. He had a creative approach to fractals, so his vision of the theory caused controversy and not everyone agreed with it. Nevertheless, his approach has many fans, and Williams indicators are included in the list of preinstalled trading terminals.

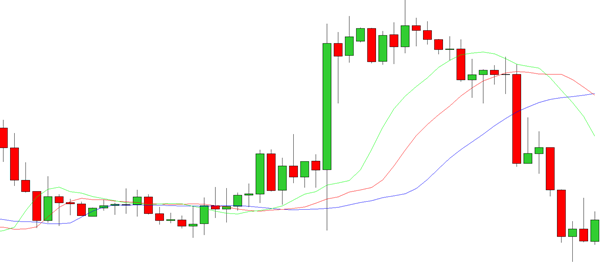

Williams fractals are used in a simplified form and are local extrema on a stretch of at least 5 bars (candlesticks). They form peculiar patterns on the price chart, based on which traders can quickly assess the situation on the market. The fractal indicator in the trading platform displays these patterns automatically and shows the direction of the fractals with arrows.

According to Williams, the decision to exit the market according to the fractal indicator is made after the closing of the last bar. But, no matter how many bars there are, the first two bars should move in one direction, and the next two - in the opposite direction to the first two. This is the pattern that indicates that we are looking at fractals. The price on the left side of the pattern is the momentum price, while the right side shows the pullback price - the difference between those prices is called "lever". The greater the lever, the higher the potential profit.

The principle of the tool is that it always lags by at least 2 bars. This is one of its main drawbacks. For this reason, it is not recommended to use fractals on a time frame less than H1, even though many traders do not consider it possible to use the tool on this time frame. For the most part, the fractal indicator is adapted for medium- and long-term time frames.

How to Read a Fractal Indicator

One of the important advantages of the fractal indicator is that it shows local extrema and allows you to see significant resistance and support levels. But it is at the breakout of these levels that the probability of false signals increases. A large number of false signals is one of the typical negative features of the fractal indicator.

Bill Williams created probably his most popular indicator, the Alligator, to filter out false signals. In particular, he recommended buying if the fractal indicator is broken out above the "Alligator's teeth" (the red line), and selling if the fractal is broken out below the red line. Fibonacci levels are also used to prevent false signals.

Fractals are used for trading on the breakout of levels. If the price is above or below the level shown by the previous fractal, it is already a breakout, according to Williams' assumptions. If the price is above the previous fractal, which is directed upwards, it is a "buyers breakout"; if the price is below the previous fractal, it is a "sellers breakout". Either way, a trader who sees these breakdowns can open a position.

Another application of the fractal indicator is trend detection. Fractals indicating a long position are more often seen on an uptrend, on the price chart, and fractals indicating a short position are more often seen on a downtrend. If the price does not overcome the previous fractal, it is likely to indicate a flat, it is confirmed by the formation of a fractal, the opposite of the previous fractal.

Fractal Indicator: Identifying Market Reversal Points

Since fractals highlight price reversal points, it is logical that as soon as the price breaks out of the previous fractal, a new price momentum arises.

A fractal breakout trade is the most obvious and simple application of this indicator. Also, fractals help identify key levels.

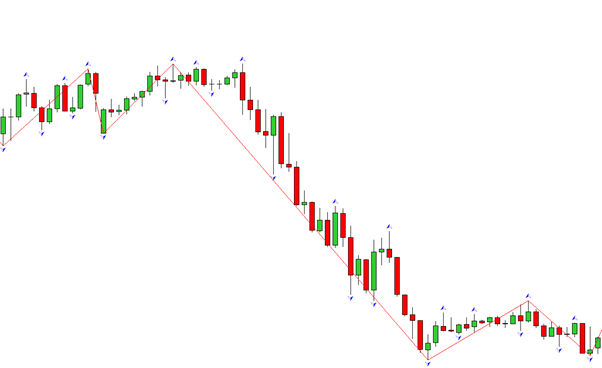

Fractals as trendline connection points

A fractal indicator makes it easy to identify and connect the most significant peaks and troughs of price movement needed to draw trend lines. Drawing trend lines using fractals can give some advantage to traders since other market participants can also use the same obvious price points.

Fractals in the Trend

In an uptrend, we see more and more broken-out upward fractals. In a downtrend, we will see more and more broken-out downward fractals. As the trend advances, there will be a series of successive breakouts and new fractals will appear. In case of an unsuccessful breakout of a fractal, we will get the first signs of a sideways price movement.

The inability to successfully break out the previous fractal creates a prerequisite for the consolidation.

Applying the Bill Williams Fractals

Dr. Williams called fractals the first dimension of his technical analysis system. Fractals are essentially short-term support and resistance levels on the price chart, and they are the fundamental building blocks of the Alligator trading system.

The Alligator trading system is quite a complex system because it uses several different indicators combined with some rules for entering the market, and scaling positions and has well-defined rules about when to exit the market.

The beauty of this system is that once you learn how to use indicators in combination with chaos theory, scanning the markets and properly understanding the current trend or lack thereof becomes child's play for you.

According to Bill Williams' trading system, fractals should be filtered using an alligator indicator:

- When a fractal appears above the level of the alligator's teeth, we should consider a long position;

- When a fractal appears below the level of the alligator's teeth, short positions should be considered.

Such signal fractals will remain valid until an entry order is triggered or a new fractal is formed. Then the position should be changed according to the new fractal. Consecutive fractals, which appear in the same direction as the one formed after the first order, can be used for adding to the open position.

The Alligator Indicator - the Key to the Use of Fractals

The alligator indicator consists of three moving averages:

The blue line is called the alligator jaw, which is a 13-period Moving Average of the average price (High + Low / 2), and it is shifted 8 candles into the future.

The red line is called the alligator's teeth and is an 8-period Moving Average of the average price (High + Low / 2), and it is shifted 5 candles into the future.

The green line is called the alligator's lips, which is a 5-period Moving Average of the average price (High + Low / 2), and it is shifted by 2 candles into the future.

When the three Moving Averages widen and move up, it signals a bullish market. On the other hand, when the Moving Averages expand and move downward, it signals a bearish market. It's very simple.

Statistically, most markets stay in a range about 70% of the time and trends occur only 30% of the time. Since the alligator trading system is basically a trend-following system, the distinguishing feature of the alligator indicator is that it can easily determine if the market is trending or trading in consolidation within clearly defined support and resistance levels.

When the Moving Averages of the alligator are compressed, it signals a sideways market, and according to the rules of the system, you should stay out of the market and wait for the next trend to appear.

The alligator trading system has several other indicators, such as the Awesome Oscillator and Accelerator Oscillator, which are used to scale positions after the system has generated its first signal. However, to get your first signal, you need to have a good understanding of how the fractal indicator works.

Consequently, once you have identified a trending market based on an alligator signal, you need to look for fractals to enter the trade first.

Fractal Indicator Trading Strategies

There are forex trading strategies that use only the fractal indicator. However, their use is very risky due to the specifics of the tool, and cannot be recommended, especially for beginners.

The most popular strategy with the considered tool is Fractals+Alligator, in which it is recommended to use any of the classical trend indicators. Pairs with average volatility are traded in the time frame of M15 and higher. It is considered important not to trade against the alligator readings in this strategy.

You should first look for at least 5 consecutive bars that show a pattern with a certain directionality, either by minimum or maximum, and the maximum or minimum should be on the middle bar. One should place long positions when the price crosses the alligator's lines and a fractal appears above the teeth of the alligator.

Orders are opened above the closing price of the bar that created the fractal. Selling is performed when the price has broken the alligator's lines and a fractal is formed, directed downward, below the alligator's teeth. Orders are opened 2-4 pips below the closing price of the fractal bar. The strategy is not implemented during the flat, which is indicated by the interlacing of the alligator's lines.

Another Williams strategy using the Fractals indicator uses oscillators: Awesome Oscillator and Accelerator Oscillator.

Within the strategy, long positions are opened when the price is above the red line of the alligator, a fractal breakout in the upper direction is marked, and the last two columns of the Awesome Oscillator histogram are green, as are the last three columns of the Accelerator Oscillator. We open short positions when the price is placed below the alligator's teeth, the fractal is broken out in the downward direction, and the last two Awesome Oscillator histogram bars are colored red, as are the last three Accelerator Oscillator bars.

Another strategy uses the fractal indicator whose signals are confirmed by the popular classic Zigzag tool. This indicator shows the most significant extrema, which makes it possible to sift out false fractal signals. Trading is performed in the time frame of M30 and above. Buy orders are opened when a fractal appears, directed downward, and the Zigzag marks a new minimum. Sell trades are opened when a fractal appears pointing upwards and the Zigzag shows a new top.

In addition, there is a strategy with Fibonacci levels, which is one of the classic strategies with fractals. It is implemented in the time frame of M15 and higher only in the direction of the trend. The main task is to correctly prepare the Fibonacci retracement. To do this, all levels, except for the zone 0.15, -0.15, -0.85, and -1.15 are removed, which means that on the chart it will look like a channel with two lines, located on both sides of it.

The strategy is used when two consecutive fractals appear in the same direction, at the distance of 20-100 points between the upper and the lower fractal, the latter is not necessary. After such fractals are formed, the Fibonacci retracement is placed on the chart. When the third fractal is already formed, the corresponding channel line is shifted so that it is drawn through it.

Then, two additional levels are marked: the first is a horizontal line through the second fractal and the second is a vertical line at the intersection of the level of 0.15 and the horizontal line. If the trend is ascending, we place a long position, if it is descending, we will sell. The Stop Loss is mandatory: if buying - below the third fractal, if selling - above it.

Conclusion

When applying the fractal indicator, you need to focus on a few rules. Thus, it is believed that it takes longer to form a pattern and it generates more reliable forex signals. In a lower time frame, fractals generate a lot of false signals. A fractal represents the beginning or end of a trend. If several fractals appear, directed in opposite directions, we should expect the formation of a strong trend in the direction of the fractal breakout.

The fractal indicator allows you to determine the entry points into trading, but it is not recommended for those who just start trading, as it is quite a difficult tool to interpret. Also, it is not recommended to predict prices with its help. Williams himself thought that this indicator is an additional one, confirming the signals of other instruments. In addition, the signals of fractals in one time frame are considered by many to be correct to check in other time frames.