Should You Invest in Tesla Before the Stock Split?

Tesla recently announced that it was going to do a stock split in the future. Now, is it time to buy?

Even though the situation is still in its early stages and few details are known about the potential split, Tesla's share price surged after the announcement in late March. And after the company's August 2020 stock split, its value soared by about 80%.

So far, it's hard to say whether a potential stock split will lead to the same impressive results. But if you've been thinking about investing in Tesla for a while, now might be a good time to buy.

What a Stock Split Means for Tesla

A stock split is a situation in which a company divides its stock into smaller pieces while lowering its price. For example, if Tesla stock is currently worth about $1,000 apiece, and the company has decided to do a two-to-one split, this means that twice as many shares will be available at half the price. That is, after the split, the investor will pay $500 per share.

In reality, the stock split doesn't change much. The market value of the company remains the same. Those who already own shares will receive more shares after the split, but the total value of the securities will not change.

However, the split may make the expensive stock more attractive to investors with limited budgets. Many investors aren't willing to pay $1,000 per share. But if the price falls to, say, $200 per security after the split, the average investor may already be thinking about investing.

Invest or Wait

When it comes to the real value of a stock, it doesn't always matter whether you invest before or after the split. Again, a stock split doesn't change the valuation of the company, so you're unlikely to benefit by investing at a lower price - you'll just own a smaller stake in the company.

The advantage of investing in Tesla before the split is that you will benefit if the split causes the stock price to rise, as it did in 2020. Sometimes a stock split causes renewed interest in the company, encouraging investors to buy shares at a lower price. If that happens, you could achieve substantial gains by investing now, before the split.

Still, no one knows exactly when the potential split will happen, and the economic climate is different now than it was in 2020. So it's hard to say how the split will affect Tesla.

Tesla Growth: Genius Musk or Harbinger of Collapse

Two years ago, in January 2020, Tesla became the most expensive U.S. automaker in history with a capitalization of $86 billion. In June of that year, the company exceeded the combined capitalization of the three German giants BMW, Daimler, and Volkswagen.

In another month of unrestrained growth, Tesla officially became the most expensive carmaker in the world, surpassing its Japanese counterparts from Toyota. At its peak, Musk's company was worth more than all automakers combined, and last October Tesla's capitalization exceeded $1 trillion for the first time.

External factors, most notably the ultra-soft monetary policy, which pushed the tech sector upward, contributed to this rapid growth. Against this background, Tesla shares became more accessible to private investors. This was facilitated by a stock split, a special stock split procedure that the company followed Apple at the end of the summer of 2020. Thanks to this, the share price dropped fivefold. From more than $2,000 a piece, the first day's trading price at the new prices dropped to $442 apiece.

At the same time, investor interest in the company only grew. Inclusion in the S&P 500 index at the end of 2020 only added weight to its securities. As a consequence, index-linked ETFs have been buying Tesla stock, further boosting demand.

Even bitcoin played in the automaker's favor last year. According to Musk, the company bought $1.5 billion worth of this cryptocurrency. Its growth also increased the value of Tesla's assets.

But the main growth factor, according to some experts, was the belief of investors in the genius of Musk and the expectation of further growth of the shares. This situation allowed one of the most respected U.S. investors Jeremy Grantham to call Tesla the main example of "wild speculation" in a heated market and a harbinger of its rapid collapse.

Musk's company was called overheated by Michael Burry, famous for foreseeing the financial crisis of 2008. He claimed that Tesla's stock growth was temporary, and as proof of his words, he shorted its shares.

What Tesla Gains Revenue From

Electric cars

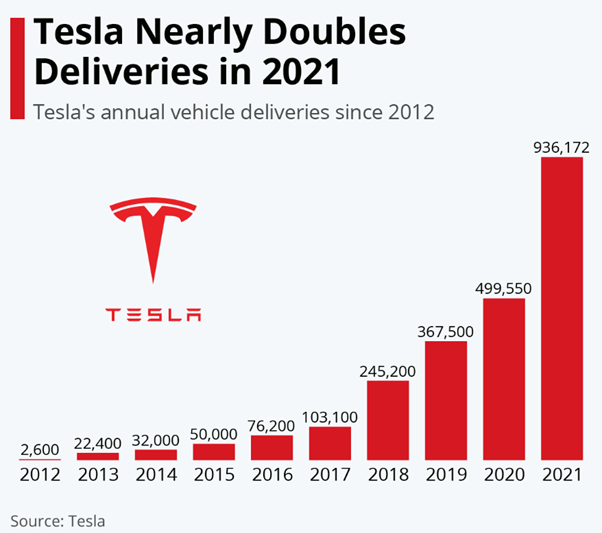

Musk's main product is electric cars, and the company is increasing its production exponentially.

Back in 2017 Tesla produced just over 100 thousand of its cars, and already in 2020 - almost 500 thousand. In 2021 the bar was raised almost twice - 936 thousand cars were produced. Several thousand more cars were sold.

Final figures for total global sales of electric cars and plug-in hybrids last year are not yet available. However, preliminary estimates put the figure at around 6 million. If these estimates are correct, that means that one in six cars sold globally that can drive thanks to electricity was made by Tesla. If we talk about "pure electric cars," Musk's share reaches almost a quarter.

Experts from the bank UBS expect that in the current year, production will further accelerate and the company will manage to produce 1.4 million cars. The company itself voiced the same forecast.

There are reasons for optimistic forecasts. At the end of 2021 the company's fourth giga-factory, located in Berlin, began its work. By the end of this year, it should produce from 5 to 10 thousand electric cars per week.

Also ahead of Tesla are the prospects of market expansion. According to the forecasts of ResearchAndMarkets, the market of electric cars (taking into account hybrids) will grow annually up to 2028 by 36% on average and will reach the mark of $1.9 trillion.

Dan Ives, an analyst with the Wedbush investment company, is even more optimistic. According to his estimations, the market for electric cars will reach $5 trillion in 10 years, and half of this sum will belong to Tesla.

Currently, Musk's company lineup is represented only by 4 electric cars: Model S (sedan), Model 3 (cheap sedan), Model X (SUV), and Model Y (crossover). Only the Roadster sports car, which was discontinued back in 2012, is out of production.

Tesla plans to produce the Roadster of the second generation, the Cybertruck pickup, and Semi truck. Earlier, Musk announced the beginning of serial production of trucks back in 2019. However, this date has been postponed several times, and now it has been moved to 2023 due to the lack of enough batteries, which now go to passenger models.

Also, the start of production of the futuristic Cybertruck has been postponed to 2023. The reason is to improve the characteristics and functionality of the pickup.

Solar panels and batteries

Electric car sales account for about 85% of the company's income. However, this is not the only thing Tesla produces. For example, the production of solar panels and batteries accounts for 5.9% of income.

Tesla Energy, a subsidiary of Tesla, is engaged in this area. Among its most famous projects are solar roof tiles and the Powerwall home energy storage system. A high-profile project of this division was also the construction of the world's largest 100-megawatt lithium-ion battery in Australia.

Service

This area generates 6.5% of the company's earnings. In particular, the company has a network of service centers - for diagnostics and repair of cars. In addition, Tesla is actively developing a network of charging stations. Last year, their number already exceeded 30,000, each of which has an average of nine chargers.

There are also more original ways to earn a substantial income. For example, Tesla sells updates to its cars. Similar to updating the operating system on a computer or smartphone. Such updates can be quite expensive. For example, an update that increased electric motor power and allowed the Model 3 to accelerate faster cost $2,000.

Autopilot

The most anticipated update to electric cars is autopilot. The company is now selling it, too, gradually unveiling new features.

Back in 2014, Tesla cars were produced with the sensors and software needed for autopilot. Two years later, these sensors were updated in new cars. Since that time, too, autopilot functions have been phased in. If it was improved cruise control, later the computer learned to change lanes on its own, park in narrow spaces, stop at signs and traffic lights, react to unexpected threats, etc.

Tesla's autopilot is still a beta version and cannot fully replace the driver. Although that is exactly the goal the company has set for itself, to eliminate humans from the driving process.

Leadership in autopilot development is one of Musk's competitive advantages. When it is ready, it can be installed by millions of car owners and older models. Not for free, of course.

Tesla's core value is artificial intelligence that analyzes data on driver location, style, and other metrics to create a single system of safe, unmanned cars. Tesla is a kind of Apple in the car world.

Financial Performance

The company ended 2020 with a positive financial outcome for the first time, earning $721 million. Last year, every quarter was financially successful for the company, and it earned a total of $5.5 billion for the year, 7.6 times more than the year before.

The company's revenue also grew last year, reaching $53.8 billion, up to $22 billion by 2020.

Tesla's earnings are up quarterly, too. While Musk's company earned $438 million in the first quarter last year, it already earned $1.14 billion in the second quarter, $1.62 billion in the third, and $2.32 billion in the fourth.

But based on classic financial estimates, the company can be considered overvalued. Its P/E (capitalization to earnings ratio) is 171. This is significantly higher than the average for American companies (the average figure for companies in the S&P 500 index is about 25), as well as for key automakers (Volkswagen, 5.2; Daimler, 5.4; Toyota, 10; Ford, 28). That is, Tesla's high valuation includes expectations for significant future earnings growth.

Why is Tesla a Promising Investment?

It is not only electric cars that are firmly associated with the name of Elon Musk. The second well-known project is the company SpaceX. But by buying shares of Tesla Motors Inc, an investor will earn a living solely in the direction of the automobile industry. Therefore, it is important to distinguish between these two businesses and keep track of news specifically on Tesla.

The release of each new model and even the announcement of concepts causes a resonance - almost every media outlet in the world reports on it. Among the most popular and already put on the assembly line are the Model S, X, Y, and 3. In 2022, the production of the Tesla Roadster 2, the fastest car in the line, is to begin. The Tesla Cybertruck electric pickup truck is scheduled for mass production at the end of 2022.

This rate of production, sales, and hype around new products has made the company one of the few whose capitalization has exceeded $1 trillion. Only 5 corporations have more:

- Apple;

- Microsoft;

- Saudi Aramco;

- Alphabet (Google);

- Amazon.

At the same time, Tesla ranks first in the world in terms of capitalization among automakers. Such trends, as well as the fact that there is also a subsidiary of Tesla - SolarCity ("green energy," electric car charging stations), indicate further growth of the stock.

At the same time, you should not invest all of your spare funds in just one asset. It is important to diversify your investment portfolio. For this reason, it is necessary to closely monitor the state of the industry as a whole, the global agenda, the laws passed regarding "green energy" in key countries for the sale of electric cars, etc. An experienced trader manages the risks.

What is the Return on Tesla Stocks?

Hardly anyone in the world can predict the future 100%. Especially when it comes to finance. That said, there are methods to predict stock prices. You can also look at how they have changed over time. Here's an example of price changes over the past two years (Jan. 08, 2020, to Jan. 08, 22):

- Jan. 8, 2020 - $93;

- January 8, 2021 - $880;

- January 8, 2022 - $1027.

The level of potential income is not difficult to calculate. However, you need to remember that there is a drop in value. For this reason, it is important to invest thoughtfully and deliberately in assets. This will secure gains and prevent serious losses.

How the Share Price Will Change

Tesla stock peaked at the end of 2021, hitting an all-time high of $1243 per share. Since then, their valuation has bounced back and was valued at $769 at the time of writing.

Experts' estimates of the growth prospects for the stock are rather restrained. According to the consensus forecast at Yahoo Finance, the company's share price will reach $933 a year.

At the same time, according to investing.com, analysts expect $863 per share.

Among those who are most skeptical about the company's prospects is Citigroup: specialists at the bank predict a decline in shares to $137. JPMorgan Chase is almost identical to them, expecting $250.

Jefferies Group and Wedbush Securities have optimistic views on Musk's company, with specialists believing that Tesla shares will rise to $1,400 in a year.

Other analysts are generally positive about the company's prospects, predicting a correction shortly and that the stock will generate positive returns over the next few years.

The company continues to build its ecosystem by investing in a network of charging stations, battery production, and merchandise, but it does not forget about its army of geek fans. Thus, in portfolios focused on the medium to long term, Tesla stock can be allocated a higher share than its weight in the S&P500 suggests, with the expectation that the company will continue to grow ahead of the market. However, it is also necessary to understand that the next 5 years will by no means be as fast-paced as the previous ones.

Some other experts expect even a more significant correction of shares, emphasizing that the company is highly overvalued now. In their opinion, the fair price of its shares for purchase is about $500-$600. It is not reasonable to buy for up to one year, because it carries a lot of risks. If you buy a company on a horizon of 5 years, now you can buy 25% of the investment in the company and add 25% every three months.

So far Tesla remains one of the most popular companies, not only among the world investors but at this stage investing in the company looks risky enough. Although the truth is that they have been so all along with the rapid growth of its stock.

Conclusion

The best investments are the ones that are most likely to provide stable growth over the long term. While a split in Tesla stock can help boost growth, make sure you see the big picture clearly before you buy. The more research you do, the easier it will be to decide if Tesla is right for you as an investment.

About AdroFx

Being a well-established brokerage company, AdroFx offers the best trading conditions to its clients from 200 countries. Founded by experts with a couple of decades of overall experience, AdroFx is one of the best platforms on the market for shares trading. Either a newbie or experienced trader, both will find here what they are looking for since the company provides various trading accounts for different trading styles and goals.