Silver Investing: Navigating Markets and Opportunities

Silver has maintained its allure as a precious commodity for centuries, esteemed for its versatility in both ornamental and industrial spheres. Its conductivity, resistance to tarnish and malleability render it indispensable in diverse sectors such as electronics, healthcare, and aerospace, besides its prominent role in jewelry crafting.

Renowned as a "safe haven" asset, silver tends to preserve its worth amid economic turbulence and market instability. Its perceived value as a hedge against inflation and currency fluctuations attracts investors seeking stability during uncertain times, thereby propelling its demand and price upwards during downturns.

While silver prices have displayed an overall upward trajectory in recent years, they remain susceptible to multifarious influences. Economic indicators like GDP growth, inflation rates, and shifts in interest rates exert significant sway over silver markets. Moreover, the interplay of supply and demand dynamics, coupled with geopolitical events, can further perturb silver prices.

Given the unpredictable nature of market conditions, investors must vigilantly monitor trends and stay attuned to factors shaping silver prices. It's crucial to acknowledge the inherent risks associated with silver investments, underscoring the importance of informed decision-making and risk management in navigating the volatile terrain of silver markets.

Factors Affecting Silver Price

Various factors exert influence on the price of silver, spanning economic, supply and demand, as well as political and geopolitical realms.

Economic factors wield a substantial impact. Interest rates, for instance, dictate investor preferences, with low rates prompting a shift towards silver over fixed-income investments, thereby boosting its price. Conversely, high interest rates may deter silver investment, leading to price declines. Inflation also plays a pivotal role, as high inflation erodes purchasing power, prompting investors to seek refuge in silver to preserve value, consequently driving prices up. Moreover, GDP growth can stimulate demand for silver in industrial applications, amplifying its price.

Supply and demand dynamics further shape silver pricing. Fluctuations in production and mining directly influence supply levels, thereby affecting prices. Industrial demand, particularly in electronics, medicine, and aerospace sectors, can bolster silver prices if it escalates. Additionally, investment demand contributes significantly, with increased investor interest driving prices northward, while divestment can lead to declines. Political instability and geopolitical tensions can create market uncertainty, prompting investors to flock to silver as a safe-haven asset, elevating prices. Government policies and regulations also impact supply and demand dynamics, consequently affecting prices.

Understanding the intricate interplay of these factors is essential, as they collectively influence silver prices in a dynamic and complex manner. Additionally, vigilance regarding currency fluctuations, market sentiment, and natural events impacting silver mining, production, and transportation is imperative for comprehensive market analysis.

Historical Silver Price Forecast

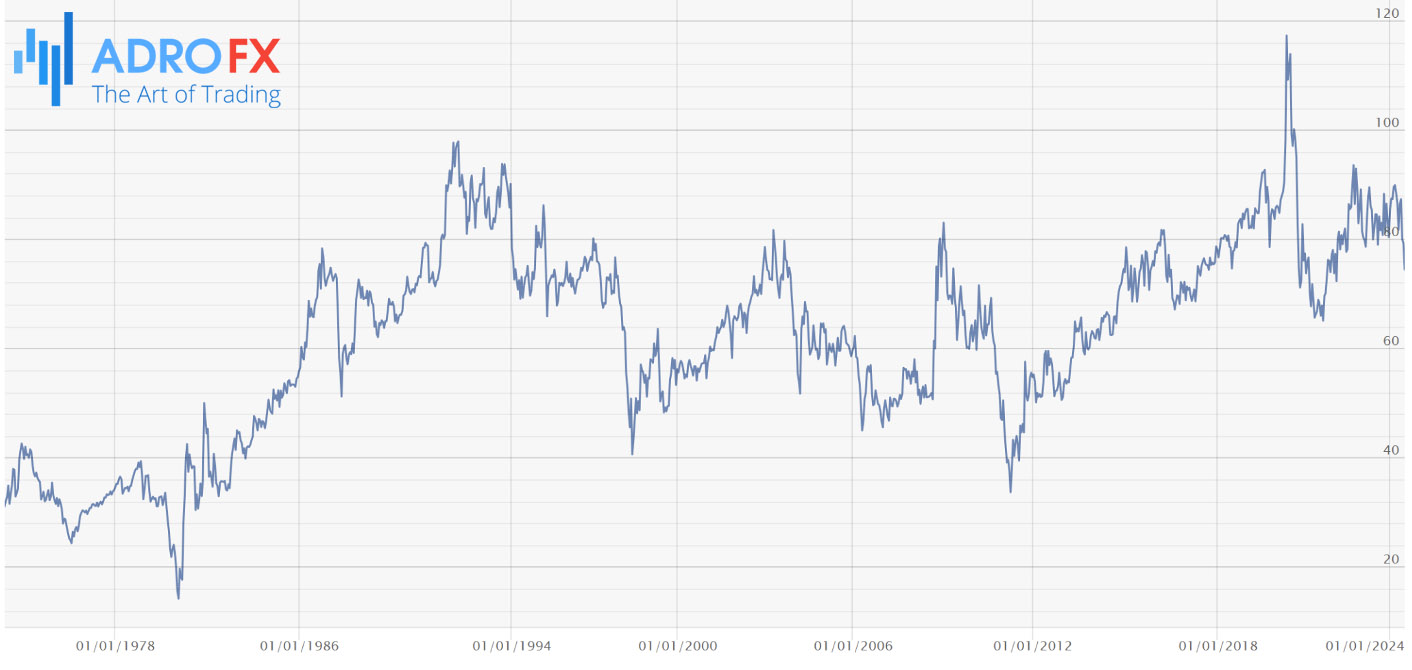

Exploring the historical trajectory of silver prices offers valuable insights into its enduring significance as a precious metal utilized in currency, jewelry, and industrial realms across millennia. Amid economic downturns and market turbulence, silver has consistently retained its value, underscoring its resilience as an investment asset.

Analyzing past silver price trends unveils a rich tapestry of responses to various economic, political, and geopolitical stimuli. By scrutinizing historical price charts, identifying patterns, and discerning correlations with economic indicators, investors can glean valuable intelligence regarding the behavior of the silver market. This historical perspective, coupled with a keen awareness of prevailing market dynamics, enables investors to ascertain potential risks and opportunities, guiding informed investment decisions.

The gold-silver ratio, spanning five decades, serves as a notable benchmark. A noteworthy signal emerges when the ratio surpasses 74:1, indicating a compelling buying opportunity for silver. Historical data illustrates instances where silver prices experienced dramatic surges following such ratios, albeit with varying timelines.

Additionally, the correlation between inflation expectations, gold, and the SPX provides further insights into silver price dynamics in 2020 and beyond.

However, it's crucial to recognize that past trends and patterns do not guarantee future performance. Contextual analysis, grounded in contemporary market conditions and comprehensive consideration of multifaceted factors influencing silver prices, is essential for accurate forecasting and informed decision-making. By synthesizing historical data with real-time market insights, investors can navigate the complexities of the silver market with prudence and foresight.

Technical Analysis of Precious Metals

In the dynamic world of financial markets, traders and investors employ various methodologies to navigate the complexities of asset valuation. Among these approaches, technical analysis stands out as a prominent tool for forecasting price movements based on historical market data. Particularly in the realm of precious metals like silver, technical analysis plays a crucial role in guiding investment decisions.

Overview of Technical Analysis and its Role in Predicting Silver Prices

Technical analysis serves as a cornerstone of modern trading strategies, offering insights into market trends and patterns that inform traders' actions. Specifically in the context of silver prices, technical analysis enables investors to identify potential entry and exit points, leveraging historical price data and chart patterns to anticipate future movements in the silver market.

Analyzing Charts and Trends for Silver Price Predictions Using Technical Indicators

Within the realm of technical analysis, a plethora of tools and indicators are available to traders seeking to decipher market dynamics. By examining charts and employing technical indicators such as the Relative Strength Index (RSI), Bollinger Bands, and Moving Average Convergence Divergence (MACD), investors can gain a nuanced understanding of silver price trends and momentum shifts. These indicators serve as invaluable resources, offering insights into market sentiment and potential trading opportunities.

Fundamental Analysis of Silver Prices

As essential as technical analysis is in the world of trading, fundamental analysis provides a complementary perspective, delving into the underlying economic and financial factors driving asset prices.

Overview of Fundamental Analysis and its Role in Predicting Silver Prices

Fundamental analysis complements technical analysis by focusing on the intrinsic value of assets such as silver. By examining factors such as the financial health of silver mining companies, industry trends, and broader economic conditions, fundamental analysts seek to gauge whether silver is overvalued or undervalued relative to its market price. This comprehensive assessment enables investors to make informed decisions about their silver investments, considering both short-term market dynamics and long-term fundamental factors.

Analyzing Silver Mining Companies, Industry Trends, and Other Fundamental Factors

To conduct a fundamental analysis of the silver market, investors delve into various aspects, including the financial performance of major silver mining companies and prevailing industry trends. Additionally, economic indicators such as interest rates, inflation, and geopolitical tensions are carefully considered, as they can significantly influence silver prices. By synthesizing these fundamental factors, investors gain a holistic understanding of the silver market, empowering them to make strategic investment decisions aligned with their financial goals and risk tolerance.

Top Five Silver Trading Approaches

Crafting a well-defined strategy is paramount when venturing into silver trading. Below are five distinct strategies tailored for silver trading:

Accumulation via Buy and Hold

Embracing this strategy entails purchasing silver with a long-term perspective, anticipating its value to appreciate over time. By steadfastly holding onto your silver holdings, you can capitalize on potential price upticks while reaping dividends or interest payments associated with silver ownership.

Seizing Opportunities with Value Investing

This approach hinges on identifying undervalued silver assets and patiently awaiting their price appreciation before selling for profit. Employing this strategy necessitates a profound understanding of the silver market and meticulous research to spot discounted assets. Although it offers the potential for significant gains, it demands meticulous analysis and may require prolonged holding periods.

Riding Waves with Trend Following

Opting for this strategy involves entering the silver market when prices are ascending and exiting upon trend reversals. Successful implementation requires vigilant monitoring of market conditions and adeptness in identifying prevailing trends swiftly. While it enables short-term gains from upward price movements, it mandates constant vigilance and swift action to capitalize on evolving market dynamics.

Exploiting Fluctuations through Scalping

This dynamic strategy entails capitalizing on short-term price fluctuations by engaging in rapid buying and selling of silver within a single trading day. Achieving success with this approach demands an intricate understanding of market intricacies and the ability to make swift decisions. While it offers the potential for quick profits, it requires significant time commitment and real-time market monitoring.

Hedging Risks with Options Trading

Delving into options contracts on silver provides traders with the opportunity to benefit from price movements while mitigating risks. By purchasing options, traders gain the right, but not the obligation, to buy or sell silver at a predetermined price. This strategy offers flexibility and risk mitigation, allowing traders to profit from price movements without owning physical silver. However, it necessitates a comprehensive grasp of options trading intricacies and associated risks.

It's imperative to acknowledge that past performance does not guarantee future outcomes in trading. Thorough comprehension of the inherent risks is indispensable before embarking on any silver trading endeavor or engaging with other financial instruments.

Anticipating the Future of Silver Prices

Short-Term Forecasts Anchored in Present Dynamics

Short-term prognostications concerning silver prices pivot on existing market dynamics encompassing supply and demand dynamics, economic and political landscapes, and a blend of technical and fundamental analysis. Analysts often deploy diverse methodologies, such as technical analysis, to discern patterns and trends within market data, thereby formulating short-term forecasts for silver price movements. Nonetheless, the volatile and uncertain nature of the market renders short-term predictions inherently challenging and potentially less accurate compared to their long-term counterparts.

Long-Term Projections Embracing Historical Patterns and Emerging Trends

In contrast, long-term forecasts for silver prices adopt a broader perspective, encapsulating historical trends and future factors including economic cycles, technological advancements, and demographic shifts. By delving into historical data, investors discern enduring trends like the relationship between silver prices and interest rates or the influence of technological innovations on silver demand. Moreover, forward-looking analysis contemplates future variables such as the evolving technological landscape's potential to alter silver demand dynamics. Incorporating both historical trends and prospective factors enables investors to make more informed decisions regarding the enduring viability of silver as an investment vehicle.

Nonetheless, it is prudent to recognize the inherent uncertainty of predicting the future, even in long-term projections, which may necessitate adaptability in response to evolving market dynamics.

Pros and Cons of Investing in Silver

Investing in silver offers a plethora of opportunities and challenges, reflecting its unique position as a precious metal with both industrial and monetary value. Understanding the advantages and drawbacks is crucial for investors considering silver as part of their portfolio diversification strategy.

Pros:

- Safe Haven Asset

Silver has historically served as a safe haven asset, preserving its value during economic downturns and periods of market volatility. Its status as a hedge against inflation and currency fluctuations makes it an attractive option for investors seeking stability in uncertain times. - Diverse Industrial Applications

Silver's conductivity, malleability, and resistance to tarnish render it indispensable in various industries, including electronics, healthcare, and aerospace. The increasing demand for silver in these sectors contributes to its enduring value as an investment asset. - Potential for Price Appreciation

While silver prices can be volatile in the short term, they have displayed an overall upward trajectory in recent years. Factors such as economic growth, inflation, and geopolitical tensions can drive demand for silver, potentially leading to price appreciation over time. - Portfolio Diversification

Investing in silver allows investors to diversify their portfolios and reduce overall risk. Silver often exhibits a low correlation with other asset classes, such as stocks and bonds, making it an effective diversification tool for mitigating investment risk.

Cons:

- Volatility

Silver prices can be highly volatile, subject to sudden fluctuations in response to economic, political, and market factors. This volatility can pose challenges for investors, especially those with a short-term investment horizon or low risk tolerance. - Market Influence

Silver prices are influenced by a myriad of factors, including economic indicators, supply and demand dynamics, and geopolitical events. Predicting these influences with certainty can be challenging, leading to uncertainty in investment outcomes. - Storage and Security

Unlike financial assets, physical silver requires storage and security measures to protect against theft, damage, or loss. This can incur additional costs and logistical challenges for investors, particularly those holding large quantities of silver. - Liquidity

While silver is a globally traded commodity, its liquidity can vary depending on market conditions and investor sentiment. During periods of market stress or uncertainty, liquidity in the silver market may decline, impacting the ease of buying or selling silver assets. - Inflation and Opportunity Cost

Investing in silver, particularly in physical form, may entail costs such as storage fees and insurance premiums. Inflation can erode the purchasing power of silver over time, potentially diminishing returns and resulting in opportunity costs for investors.

By weighing these pros and cons carefully, investors can make informed decisions about incorporating silver into their investment portfolios, aligning with their financial goals and risk tolerance levels.

Final Thoughts

Silver remains an intriguing asset for investors, blending stability with growth potential. Its diverse applications and status as a safe haven offer unique opportunities within portfolios.

Navigating silver markets requires acknowledging both risks and rewards. Economic indicators, supply and demand, geopolitics, and technology all influence silver prices. Understanding these factors is key for informed decision-making.

Technical and fundamental analysis provide valuable insights into silver markets, aiding investors in navigating trends and seizing opportunities.

Various trading approaches cater to different risk appetites. Whether adopting long-term strategies or short-term tactics, investors can align their approach with their goals.

While short-term forecasts hinge on current market dynamics, long-term projections consider historical patterns and emerging trends, offering a broader perspective on silver's potential.

In conclusion, silver presents opportunities for diversification and stability in investment portfolios. By staying informed and prudent, investors can harness its potential as a valuable asset.

About AdroFx

Established in 2018, AdroFx is known for its high technology and its ability to deliver high-quality brokerage services in more than 200 countries around the world. AdroFx makes every effort to keep its customers satisfied and to meet all the trading needs of any trader. With the five types of trading accounts, we have all it takes to fit any traders` needs and styles. The company provides access to 115+ trading instruments, including currencies, metals, stocks, and cryptocurrencies, which make it possible to make the most out of trading on the financial markets. Considering all the above, AdroFx is the perfect variant for anyone who doesn't settle for less than the best.